Content

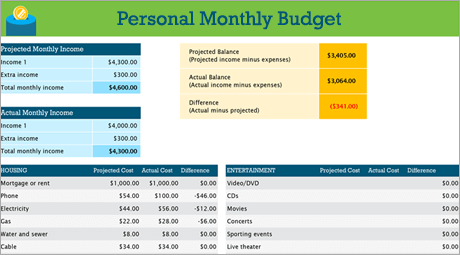

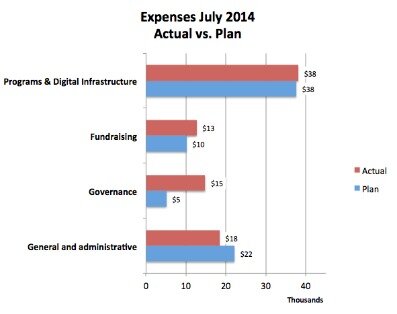

Create one or more reports that return data from your tables. Typically, you’ll use SUMIFS, SUMPRODUCT, INDEX-MATCH, AGGREGATE, SUM, and/or array formulas to return this data. Most Board members have widely diverse backgrounds and very little time. I would say you need to be concise but include of course the KPI’s relevent to your business. A line by line P&L will contain too much detail – but key lines compared to your budget, and/or forecast will be necessary – Month, quarter and YTD. A comparison with prior year actuals can also be of interest.

Maintaining an efficient, productive work environment, and ensuring that you can identify any employee discrepancies or issues is critical to being proactive about business growth. Now we will take a look at some financial statements examples to get a clearer picture of what can be tracked in weekly intervals. Generally, costs should not be looked upon purely on the base of black and white. If sales and marketing cause cost increment, maybe they also deliver high volumes of revenue so the balance is healthy, and not negative. An indicator over 1 means that the company is making a profit above all expenses while a coefficient below 1 will indicate that the company is losing money.

Most companies produce weekly, monthly and quarterly financial reports, which include information such as profit and loss statements, a balance sheet, accounts payable, accounts receivable and a statement of cash flows. A financial report is an informational document about the financial health of a company or organization, which includes a balance sheet, an income statement and a statement of cash flows. Financial reports are often reviewed and analyzed by business managers, boards of directors, investors, financial analysts and government agencies. Reports must be prepared and disseminated in a timely manner, and they must be accurate and clear. Although creating a financial report may seem daunting, the accounting required is not all that difficult. Here are five key financial reports that can give business owners valuable perspective on the growth and development of their businesses.

Monthly Management Accounts Template

When you make sure to all is for the same objective of the documents. You can also include the name of reports like ABC organization and strategy report.

If you move with your perspective and discuss all objectives, reports management works best. Also analysis with some of the necessary recommendations and supporting statistics or projects. It enables event organizers to adequately plan for an event by showing the cost of each item and the expenses incurred or expected to be incurred.

(The ratio can be calculated by dividing the period-ending balance of accounts receivable by revenue for that period, then multiplying the result by the number of days in the period). Looking at that ratio over several periods can indicate whether receivables are piling up faster than sales or faster than the company’s ability to collect. You can also compare that ratio to Accounts Payable Days (calculated by dividing the period-ending balance of accounts payable by the period’s cost of goods sold, multiplied by the number of days in the period). AP Days indicates how long it’s taking the business to pay suppliers, so like AR Days, it has a major influence on the company’s cash situation. Like other financial ratios, both AR Days and AP Days can vary widely by industry.

Usually, it keeps the track of mandatory information of thirty days. As well as the version of Microsoft word and specifically Microsoft Excel. Learn about the eight core bookkeeping jobs, from data entry to bank rec, reporting and tax prep.

This is measured by dividing your business’s net income by your shareholder’s equity. These KPIs are particularly helpful to benchmark your company against other businesses. It doesn’t include revenue earned from investments or the effects of taxes. To manage financial performance in comparison to a set target, you can also use a modern KPI scorecard. That way, you will not only monitor your performance but see where you stand against your goals and objectives. In the overview, we can see that scatter plots and bubble plots will work best in depicting the relationship of the data while the column chart or histogram in the distribution of data.

Who Creates Financial Reports?

This KPI is a crucial measurement of production efficiency within your organization. Costs may include the price of labor and materials but exclude distribution and rent expenses. If customers are unsatisfied, it can also cause damages from outside of your team that can, consequently, influence the financial performance as well. If you see that most costs come from administrational activities, you should consider automating tasks as much as possible. By utilizing self service analytics tools, each professional in your team will be equipped to explore and generate insights on their own, without burdening other departments and saving countless working hours. The quick ratio/acid test report example is worth tracking – by measuring these particular metrics, you’ll be able to understand whether your business is scalable, and if not – which measures you need to take to foster growth.

For example, you can schedule your financial statement report on a daily, weekly, monthly, or yearly basis and send it to the selected recipients automatically. Moreover, you can share your dashboard or select certain viewers that have access only to the filters you have assigned. Finally, an embedded option will enable you to customize your dashboards and reports within your own application and white label based on your branding requirements. You can learn more about this point in our article where we explain in detail about the usage and benefits of professional embedded BI tools. No matter if you’re a small business or large enterprise, you need to clearly define your goals and what are you trying to achieve with the report. This can help both internal and external stakeholders who are not familiarized with your company or the financial data.

You can just do cash flow, starting from your business’ last busy season through the end of the next, graphics are better than numbers. If you have questions beyond that, drill down into your business’ drivers, that is, what makes your money. First of all, the company should define what they needs to make a following of the business. There are many Key Performance Indicators and the board should define wich are appropiate to their business. The left hand side of the one pager was a rear view mirror and the right was a windshield. I presented this one pager to an executive committee of the board and it gave them enough insight to oversee the company and evaluate executive management.

Standard Monthly Financial Reports

To write a financial report, format a balance sheet that lists assets, liabilities, and equity. Combine the totals for each category and include the final total at the bottom of the sheet. Next, create an income statement page to list revenue, cost of goods sold, operating expenses, and retained earnings, then sum those categories. Lastly, create a cash flows statement page to compile operating, investing, and financing activities and include a sum at the bottom. Financial reporting is compliance-oriented and is used for external purposes.

- This section also often includes details about the company’s tax situation, pension plans, and stock options.

- The set of reports are normally available by the 5th business day of the month.

- The first three reports – collectively known as financial statements — are critical to seeing the big picture of your business, Hamilton notes.

- Taken together, these reports tell you what your business is worth, how profitable it is, and if it has enough money coming in to keep trading.

- Also analysis with some of the necessary recommendations and supporting statistics or projects.

It should include much more than just your financial statements. Statement of Cash Flows – This financial statement blends information from both the income statement and the balance sheet to give a picture of how cash is going into and out of a business. For a business owner, the “cash flow from operations” line is one of the most important across all financial statements. It shows over the period listed the net difference of cash that came in and cash that went out on an operating level. “In my experience working with companies in banking and consulting, I find that most business owners typically struggle to get a strong handle on their cash flow,” Hamilton says. You want to be focused on growing the business.” Looking regularly at cash flow from operations gives better perspective on the health of the business, allowing owners to concentrate on how to improve results.

Unless your board requests monthly financials, stick with high level figures that are meaningful to them. If they approved the budget they need to know how you are running compared to the target. The monthly management report is the report that shows your company’s financial and operational performance on a month to month basis.

Tips For Designing Monthly Financial Reports

This is to the purpose of your monthly management report to recheck your strategy. The best report contains all data with your management team have to make decisions. to see the performance or financial status with a specific group. Whereas the index tool is about to illustrate by charts or graphs for reports.

You may not have all of these reports each month, depending on what applies to the selected department. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. Gross Profit is the earnings after direct costs of production are deducted from Revenues. A low gross profit typically means a competitive market so prices are not easily raised and manufacturing costs are not easily reduced.

The essence of a monthly financial report should include relevant data that is easy to read and to comprehend. A board portal system by Diligent puts financial reports at board directors’ fingertips at any time of day or night. Back in the day, month end reports consisted of a income statement, balance sheet, and maybe a cash flow statement. These are the three statements that made up your financial statements for month end reporting. As technology advanced and people got smarter about tracking trends, analysis, and operations today, the month end report includes much more. In this week’s blog, I answer the question, what should your month end reports contain?. AR Days vs. AP Days – Accounts Receivable Days is the number of days until a company gets paid for its goods or services.

Access your Strategic Pricing Model Execution Plan in SCFO Lab. The step-by-step plan to set your prices to maximize profits. Browse the Business Exchange to find information, resources and peer reviews to help you select the right solution for your business. By signing up, you will receive emails from Proformative regarding Proformative programs, events, community news and activity.