Content

The basic double-entry accounting structure comes with accounting software packages for businesses. When setting up the software, a company would configure its generic chart of accounts to reflect the actual accounts already in use by the business.

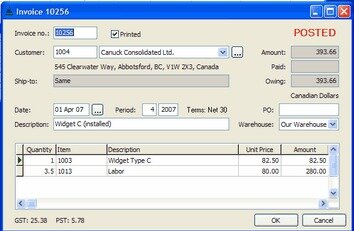

Bokio are continuously working behind the scenes and you can be added to their email list to be notified when any new features are integrated. The above features are all completely free but for£10 a month you can get priority support. Create and send invoicesto customers with a few clicks and receive notifications for overdue invoices.

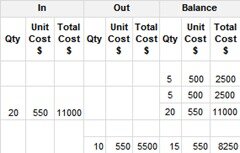

The total dollar amount of debits must always equal the total dollar amount of credits. If you attempt to post an entry into accounting software that is not balanced, you’ll get an error message.

With the help of this freeware you can keep a eye on your income and expenses. It lets you manage that money which you deposit into your bank account and various other expenses in the current financial year. This freeware lets you manage your financial transactions easily as on a yearly or monthly basis. JMoney is a free accounting software for your computer. This freeware will manage your finance and accounts. With the help of this software you can keep a eye on your expenses and income. It also lets you import data from various accounting software.

Top 5 Free Accounting Software For Small Businesses

Bank reconciliation – import a CEV download of your bank statement for automated matching of transactions . These companies can provide their bookkeeping software free because they make their money with upgrade add-ons or personalized services and so on. QuickBooks Desktop remains a favorite among small business owners. Read our review of this popular small business accounting application to see why. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management.

The total of the trial balance should always be zero, and the total debits should be exactly equal to the total credits. Income accounts represent money received, such as sales revenue and interest income. Liability accounts show what the firm owes, such as a building mortgage, equipment loan, or credit card balances. Asset accounts show dollars associated with things a business owns, such as the cash in its checking account or the price paid for its warehouse. Because the accounts are set up to check each transaction to be sure it balances out, errors will be flagged to accountants quickly, before the error produces subsequent errors in a domino effect. Additionally, the nature of the account structure makes it easier to trace back through entries to find out where an error originated.

Once the bookkeeper records and organizes all of the transactions, the next step of accounting is to analyze these transactions into helpful reports which will show the state of one’s finances. These reports can include profit/loss statements, cash flow reports, and can track sales tax to keep a close eye on what is owed come tax time. With the help of this freeware small trade owners handle their finance and accounts such as sales analysis, inventory, general ledger, accounts receivable and payable etc.

You can also use the tool to automate transaction processing, data entry, and approvals. Many readers share how easy it is to customize work within Sage Intacct, from invoice and email templates to full reports. Sunrise is an outstanding accounting program for a service-based company, except for the lack of bank reconciliations.

Turbocash

Accountants use debit and credit entries to record transactions to each account, and each of the accounts in this equation show on a company’s balance sheet. Shelley Elmblad is an expert in financial planning, personal finance software, and taxes, with experience researching and teaching savings strategies for over 20 years. When a goods or services sold to clients is bring in a value for the business that is called income. In personal finance, income is increased asset value.

It provides the exact status of the financial position of your company. If you are looking for a free and easy to use financial accounting software then you will find this freeware very useful. With the help of this freeware you can keep a track of all of your accounts, expenses and income. It lets you give information about financial years, budgetary lines and other third party information which is useful for you.

Kashoo is beloved by GetApp readers for its simplicity. It’s designed specifically for small business owners who are often on the go and want to balance their own books themselves. GetApp reviewers rave about Kashoo’s easy interface, collaboration with accountants, and quick customer service. All of these help users climb the double-entry accounting hump. Double-entry accounting’s goal is to help you record each transaction in the accounts where money comes from and the accounts where money ends up. When the total of all debit entries matches the total of all credit entries, each transaction is considered “in balance.” This helps you create correct financial statements. We considered an array of accounting software for small businesses that offered a plan that is free forever.

Sole proprietors and freelancers can often use free accounting software to track income and expenses to file tax returns. We’ve identified five great free accounting software for small businesses. CS Ledger is a free accounting software for your computer. With the help of this freeware you can maintain your books of accounts, keep an eye on your income and expenses, record financial transactions etc. This freeware also lets you make balance sheet, bank reconciliation statement, purchase account , trial balance, profit and loss account etc. Double-entry software platforms provide your business with the most accurate view of its finances. While single-entry methods only record income and expenses, double-entry accounting takes assets and liabilities into account.

You can use keyboard’s Insert key to add new transaction. You can open multiple child accounts for a selected account. When you exit this software, it automatically saves the data. It has a transaction scheduling facility for reoccurring transactions.

QuickBooks Online is a mean, green, double-entry accounting machine. Research from GetApp revealed in 2017 that it’s by far the most popular accounting software among small business owners in the U.S. That’s largely because you can view all your information from its online login portal.

Double-entry bookkeeping software balances your books in a myriad of ways. One way is access to more lucrative lending opportunities, since lenders prefer more complete accounting methods. Providing a more accurate snapshot of financial health enables better business decisions. Reductions in error frequencies and impacts offer cost reductions and increases in record accuracy. Additionally, more precise financial records ensure transparency.

Bs1 Accounting

Finally, we evaluate the software on pricing, ease of use, and our own expert evaluation. General ledger accounts are the place where all financial transactions of a business are categorized. Each account has a ledger showing details of money received or spent. A Chart of Accounts helps a business classify income and expense transactions into specific categories and is like a map to the general ledger accounts. All popular accounting software applications today use double-entry accounting, and they make it easy for you to get started, allowing you to get your business up and running in an hour or less. It’s possible to manually create multiple ledger accounts, but if you’re making the move to double-entry accounting, you’ll likely want to make the switch to accounting software, too. Double-entry accounting and double-entry bookkeeping both use debits and credits to record and manage financial transactions.

- The best way to get started with double-entry accounting is by using accounting software.

- If you don’t establish a live connection with your bank, you can still import your bank account transactions from a CSV file and perform a complete bank reconciliation.

- However, you must remember the fundamental principles for your business’s finances.

- Capitalize on every opportunity with software built to help Investor Relations professionals maximize their relationships.

- Home Bookkeeping Lite is a free bookkeeping software with limited functionality.

Double-entry bookkeeping is used to minimize accounting errors and to keep the books in balance. When entering business transactions into books, accountants need to ensure they link and source the entry. Linking each accounting entry to a source document is essential because the process helps the business owner justify each transaction.

If most of your transactions are manual checks, then a live bank connection is not necessary, and this might be terrific software for you. NCH Express Accounts has comparable features to GnuCash but is much easier to use. Most transactions can be accessed from the home tab, which displays transaction types in an easy-to-understand format based on workflows.

We’ll show you how to create an invoice, make recurring invoices, send reminders, and more. Common account types and how they are increased or decreased. Using this system reduces errors and makes it easier to produce accurate financial statements.

You can use this portable .JAR file from any folder. It has four catalogs Accounts, Categories, Contractors, and Numbers. You can add sub categories to these catalogs as per need. By default it creates a “database.db3” database file in the same folder where this executable JAR file is. You need to keep the JAR and DB3 file in the same folder. As it is a single database file, so it is easy to backup this file manually. You can make backup of database by clicking “Backup database” button on its interface.

If you have not computerized your accounting, you should seriously consider doing so. Most of the accounting software being offered has a trial version that you can use to see if it fits your needs. A complete back office solution that combines detailed financial statement reporting, a true general ledger, cash management and workflow standards. With native apps for iPhone and iPad, Kashoo prides itself on letting users do their books, pull profit and loss statements, and review balance statements on any device . Every action you make within Kashoo is recorded, and real-time dashboard views help you compare debit against credit entries. Eileen, thank you for your informative article on different accounting packages.

Our robust small business accounting reports are easy to use and show month-to-month or year-to-year comparisons so you can easily identify cash flow trends. The transactions will appear in your bookkeeping automatically, and you can say goodbye to manual receipt entry.