Content

This will give you more time to focus on your day-to-day work and even help you plan future growth. Plus, if your bookkeeping is organized you will be less likely to have mistakes on your tax filings and will be less likely to be red-flagged by the taxman.

- And if you use an accountant, you can shrink your hourly bill by having everything organized ahead of time.

- A fixed price agreement will typically include an interview/meeting between client and bookkeeper to establish a perfect price.

- You can then track time and expenses, send invoices, and manage everything about that client in one place.

- As a freelance bookkeeper, you will be wearing many hats throughout the typical workday.

- Bookkeeping services will provide you with a look into your cash income, expenses, cash flow, and your business’s growth.

Since both TurboTax and QuickBooks are Intuit products, they’re integrated. Automatically transferring data from QuickBooks into TurboTax when it’s time to file taxes saves hours—or days—of manual calculations and data entry. After testing nearly 40 accounting and bookkeeping apps, we narrowed the list down to the following 11 tools.

As a freelance bookkeeper, you will be wearing many hats throughout the typical workday. To accommodate the needs of your potential clients, you should expect to handle at least a handful of the following duties. General Ledger— The backbone of your bookkeeping business will rest on your general ledger. The general ledger is where a company’s financial accounts will be summarized. Accounts Receivable —Accounts receivable are considered legal claims to a payment owed for goods/services rendered. In short, managing accounts receivable will entail going through invoices and payment details between client and customer.

In case your customers decide to close the deal, you can just change the status of the quote to invoice and you’ll be good to go. The sale will take place and your customers will be able to pay you right away. In case you can’t exactly precise each detail of the sale, you can also create estimates by inputting approximate prices or hours that will take for the order to be concluded.

Flexjobs has been serving up freelance bookkeeping opportunities since 2007. Established by Sara Sutton Fell, Flexjobs offers remote, freelance, flex, and part-time job opportunities to its members.

Monthly Tasks For Good Business Health

And if you ever decide it’s time to grow your business, Wave has the features you need to scale your accounting operations. It lets you add unlimited collaborators if you bring on someone to help with bookkeeping, run multiple businesses from a single account, and even manage payroll and payroll taxes. If your business and personal accounts are combined, you can swipe left or right on the mobile app to tag expenses as either business or personal. And if you turn on automatic mileage tracking, the app records the number of miles traveled every time you drive. Because self-employed persons don’t receive regular salaries and paychecks, it’s important that they take steps to secure sufficient cash flow. Along with sending your clients invoices that look professional and arrive on time, be sure to follow up on any late invoices. Doing this helps to ensure your livelihood and continue your business’ operation.

If you create estimates for large projects as part of your business, FreeAgent may be the right accounting app for you. Directly within the tool, you can create and send project estimates to prospective clients. If those prospects become clients later, track future invoicing against those estimates to see which of your contracts are profitable and which aren’t. Did you find yourself right at home during your accounting class in college?

You’ll be able to keep tabs on outstanding invoices, so you can collect payment. It can be hard to keep track of who owes money, when, and how much. When you’re starting out freelancing, you only need to send invoices and track expenses for a few clients.

Since you can’t input business miles driven, you’ll need to calculate the deduction manually and make a journal entry to record the expense on your books. However, for freelancers that don’t mind a few manual calculations, this free software will work great. We considered a wide range of software based on pricing, features, ease of use, and our own expert analysis.

Xero integrates with more than 700 apps—like Shopify, PayPal, Stripe, and Gusto—through its app marketplace. You can start out using it to send invoices, monitoring payments as they come in on Xero’s dashboard. Then, you can connect it to your bank and payment services to manage all of your finances. Upgrade later if you hire team members and need to manage payroll from Xero as well. Like QuickBooks and FreshBooks, Wave connects directly to your bank or credit card accounts, pulling in all of your transactions so you can easily capture business expenses.

Track your personal and business expenses by recording all your purchases. These expenses can be categorized in a number of pre-set categories or in custom ones. Each transaction can be entered manually or through automated receipt data entry tools. Attach source documents for each expense you have and to each transaction you want.

Save Cash For Taxes And The Unexpected

Make sure you close off your accounts at the end of each reporting period to ensure reporting is relevant to a certain period, so it will be easier to compare. Transparency also helps your business by giving you a clear idea of where your money is going and coming from.

Today is the day you take back the control of your business with bookkeeping that works for you. Reconciling bank transactions should be top of mind for every new leader, but it is overlooked by too many. Reconciling your bank transactions will help you keep your books organized and matching your bank accounts. Financial reports can make business decisions a lot easier to make, as the reports provide a more detailed look into where the business is at and where it is trending.

Whereas I generally like to learn new things and try out new apps, I’m just not ready to invest the time into changing yet. There may be legal requirements in terms of your financial record keeping, depending on where you’re doing business. Failing to keep proper records could result in significant penalties and fines. As you make bookkeeping a part of your daily routine, you’ll be able to spend less time on it.

With the right software, it’ll give you invaluable insights into your freelancing business. The government is unlikely to be lenient if you fail to pay your tax bill. So put the money aside and record it when doing your bookkeeping. Unlike a regular employee, your tax isn’t deducted from your pay packet. That means you need to plan to put money aside for your tax bill and you need discipline. It’s important to get into the habit so you don’t get caught out at tax time.

If you find it challenging to keep up with your finances, it can be beneficial to hire a bookkeeper, an accountant, or both. This is extremely important – it’s easy to lose sight of the big picture when you’re constantly working for multiple clients. With good bookkeeping you get a clear picture of cashflow, income, expenses and business growth. You can set reminders that let you know when an invoice is approaching its due date. With modern accounting software, reminders can also be sent to the client – automatically. Every hour you spend on bookkeeping, accounting, and tax-related tasks is an hour that you’re not earning any income.

When you’re starting out as a freelancer, you may not have a lot of excess cash to throw around. But even if you’re not making much, you still need to keep track of your income and expenses. If you don’t have a solid background in finance, you may want to consider purchasing a small business accounting software program to help keep your books in order.

Pros Of Freelance Bookkeeping

Eventually, you’ll get a business bank account and want to track expenses separately—and perhaps will need to make custom documents for clients, track time spent on projects, and more. And if you upgrade to a mid-tier plan, you also get tools to help you send proposals, collaborate with an accountant, and charge late fees on overdue invoices. When you envisioned what it would be like to work as a freelancer, you probably imagined days spent writing, coding, designing, or doing something else that you love. You certainly didn’t daydream about scanning receipts, logging expenses, sending invoices, and filing your taxes. But those tasks are an inevitable part of working for yourself in every role and industry.

We also evaluated features that are useful specifically to freelancers, such as the ability to transfer information to their Schedule C tax return. When evaluating these software, we applied a higher weight to items important to freelancers and a lower, or no weight, to features unimportant to freelancers. Here is a summary of accounting software features that most freelancers will find either important or unimportant. Having separate accounts gives an easier visual of how much money you have linked to your business at any time.

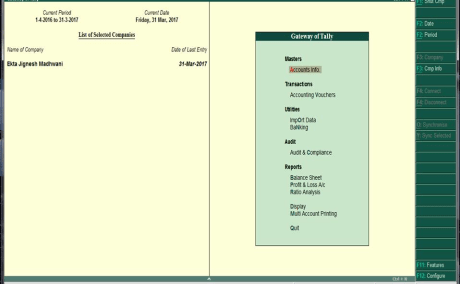

With my point of view, I think QuickBooks online is the best accounting software either be the small and medium business as well as easy to start. Instead of a customer support telephone number, QuickBooks requires customers to contact them through its QuickBooks Online program. You submit your question and your telephone number, and you will be contacted as soon as possible. Based on user reviews, this system isn’t very popular, but it should work fine as long as the callback times are not too long.

As such, they have different requirements for accounting software than most businesses. For example, since freelancers don’t generally have employees, they don’t value integrated payroll when evaluating accounting software. Other features are essential for freelancers, such as the ability to track time and expenses to bill to clients. Online Invoicing is one of the most essential features for any freelancer.

All while helping you and your accountant be more ready for tax season and a potential audit. Track and manage your sales taxes by inputting all sorts of municipal, state, regional, provincial, federal, or any other kind of taxes into your books. You can set up different names for each tax, and you can relate specific taxes to specific products or recurring transactions to save time. In this way you’ll be able to see the total amount of sales tax for each quarter of the year with no effort.

Clarity makes life as a freelancer much easier when future financial problems are avoided by helping you decide what business expenses are necessary for your business. Above all else, when you are a new freelancer, you need to get paid.

They then put aside the appropriate percentage of their income each month. But even if you hire an accountant to prepare your taxes for you, QuickBooks Self-Employed is an excellent bookkeeping tool, particularly for tracking expenses and tax payments. Connect it to your business or personal bank and credit accounts to automatically capture all transactions. For freelancers in the U.S., QuickBooks also calculates how much you owe in federal taxes each quarter so you never overpay or underpay. QuickBooks Self-Employed is one of the easiest ways for freelancers to compile their income and expenses, but the program does little else.