Content

Xero’s default reminders are sent at 7, 14, and 21 days after each invoice due date. If you don’t need this level of detail, we have a shortcut for you.

The depreciation will be posted in the respective accounts. You can confirm by running the income statement and/or the balance sheet and check the depreciation accounts. Since maintaining proper depreciation record is necessary for accurate accounting, in this article, we will see how to account for Fixed Asset Depreciation in Xero. I do not know your chart of accounts but if you need to create a new account you could make the type Other Income. That way the gains will be shown separate from the charity’s normal income sources. If the investment had been set up as a fixed asset or current asset account then the change in value could be done by a journal. I created it as a bank account, and assigned its then value, from the manager’s valuation report, as an opening balance.

To add a new code – select ‘Add account’ at the top of the page and populate the ‘Account Type’, ‘Code’, ‘Name’ and ‘Tax’ fields. ‘Description’ isn’t mandatory but feel free to add this if you like (it won’t appear in any reports but can be a helpful reminder).

You could raise an invoice for the capital commitments, but that will leave a debtors balance. You could raise a repeating invoice if that would be appropriate (e.g., $10,000 per month for 6 months on the first of the month). Or, you could simply record the contribution when it comes in.

How To Account For Invoice Financing In Xero

When you transfer the cash to your business, log it as a bank transfer from your IF account to your normal bank account. Businesses that invoice their customers can experience cashflow pinch points as they wait for clients to pay. Invoice financing allows businesses to unlock cash from unpaid invoices, ensuring they have enough working capital to keep their business running while waiting to be paid.

When I originally created the obligation or debt I created it as a bill. I have been making payments against it but the balance of the bill keeps increasing.

- When Satago advances the funds to you, we will set up the liability and the bank transaction for you to easily match in Xero.

- Then, when your customer pays their invoice, the lender will collect the amount that was advanced plus their fees and the remaining funds will be transferred to you.

- You can then edit some of the default tax rates that are required by your specific taxing authority.

- If there is a difference between Xero and the Bank Statement, then there are missing transactions that need to be imported or duplicate transactions that need to be removed.

- You can reconcile the account transaction against statements from your IF account using Xero’s Mark as Reconciled tool.

Then, when you make a monthly repayment, this will appear in your bank account for reconciliation, will be picked up by the bank rule, and all you will need to do is hit the ‘OK’ button. Select “All depreciation up to and including” in “Depreciation for this financial year” to account for the depreciation. Enter the date till when you have to apply the depreciation in the “Date” field. Enter the disposal date, amount received from the disposal and the sales proceeds accounts in the “Date Disposed”, “Sale Proceeds” and “Sale Proceeds Account”. The advantage of using Xero is that if you’ve been recording the depreciation all right, all the calculations of whether you made money or lost on selling it. As soon as you save, the depreciation will rollback to the month you set and the rest of the depreciation will be deleted.

Help Account For Hire Purchase Transaction

Select whether you want to account for the usage period of the based on the number of months or days in the “Averaging Method” field. Enter the asset’s serial number in the Asset Number drop-down list.

It’s important to record any losses in your accounts, because that will reduce your overall tax bill. You won’t want to be taxed on something that’s been destroyed, or on a profit that you haven’t made. So your stock numbers will change over time and it’s important to record these changes in your accounting software. Every head has a value, and that value should be recorded.

Accounting for all these factors is far from straightforward. But with a little thought and planning it’s possible to get into a routine of managing the finances for every aspect of your farm’s operation. Here are ten important points to bear in mind about farm accounting.

This means that there is the potential for data to be deleted or for users to go back and make errors in periods where reports and tax have been finalised. If you don’t do it, you can potentially change the historical record of what has already been reported to the tax authorities. By default, invoices sent by Xero cloud accounting software won’t be able to be paid online immediately. It’s a no brainer to accept online payment, and it’s a 5-minute job.

Invoice finance is a useful way for businesses to cover short-term cashflow gaps and Satago’s enhanced integration with Xero makes accounting for invoice finance quick and painless. When you apply for invoice finance, the lender will advance you a percentage of the value of your invoices (usually between 70-85%), you’ll receive this money in your bank account.

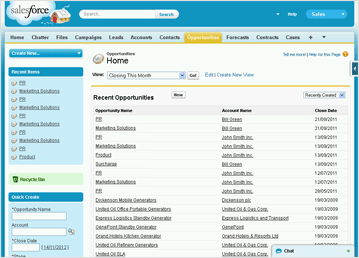

Yes, I’d like to receive weekly tips to grow my business, resources and special offers from Bean Ninjas in my inbox. Why not save yourself some stress and have an experienced professional set up your Xero file for you? If you wish to see the default tax rates in Xero, go to the Accounting menu, select Advanced, and click on Tax Rates. You can then edit some of the default tax rates that are required by your specific taxing authority. Xero integration with your CRM allows you to create and update customer information in Xero from the CRM.

How To Enable Satagos Enhanced Xero Integration

It’s just like businesses that use Cost Centres. The COA remains the same size, but the Cost Centres are used to distinguish between different departments. Come on Xero…you haven’t “revolutionised” anything here. Might be nice for small businesses, but not very helpful for small charities who need to break their expenses down 4 different ways. Agree with Chris other reports need ability to customize as does budget manager need layout options available. I love the simplicity of Xero’s customised report layouts – I think it’s pretty much best in class. Sign up to our newsletter for the latest tips on running your business more efficiently.

Even if you do hire an accountant, you’ll still need to keep some important financial information at your fingertips. When you and your accountant work together in the cloud so you can both access the figures, it’ll help your farming business run much more efficiently. Luckily, for farmers who want to go it alone there’s now a range of good quality software, most of it cloud-based, to help simplify the accounting process. As we’ve seen, farm accounting is a big topic.

getting real-time control over your finances, key numbers and reporting. But to realise the true benefit of this functionality, you’ve got to get your hands dirty and start tailoring the Chart of Accounts and accounting codes in Xero. Both elements of the transaction should be set to No VAT as you will have already reclaimed the input VAT. Post the Purchase Bill in full for the van, coded to the fixed asset Motor Vehicle cost account. Make sure to include the VAT as per the physical invoice that you will be entitled to reclaim.

Not having good advisors can often cost you more than what you would have paid them in fees. A major benefit of Xero Tax is that it’s included at no extra cost as part of the partner programme. Xero Tax is only accessible through Xero HQ which is currently available to accountants and bookkeepers in the Xero partner programme. However, we are always evaluating our product portfolio so thank you for sharing your thoughts with us. Learn how Xero Tax works with step by step instructions on setting up, as well as preparing and filing returns. To help you get the most out of Xero Tax, we’ve created world-class education courses, insightful knowledge articles and interactive webinars.

Xero accounting software is all about making tedious tasks like bank reconciliation easier. This video tutorial shows you how to set up a bank feed to help automate your transaction entry and bank reconciliation in Xero. Create new HP liability account within the chart of accounts for the new loan agreement. Make sure that ‘enable payments’ box is ticked when setting up the options here as this will allow you to ‘pay’ the purchase bill for the van against the account. Remember the accounts we created in the Xero Chart of Accounts above?

So the way you manage your accounts will be different too. Find out the top ten factors to consider for farm accounting.

For more information about this refer to this longer post on bank reconciliations. Automated invoice reminders allow you to prepare custom email templates to go out when invoices are a certain number of days late.