Content

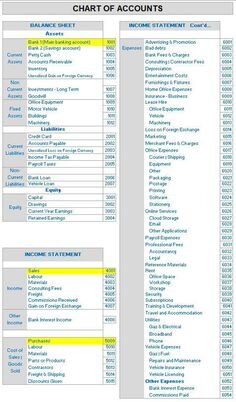

Is it a prepaid asset or an expense that was paid out? The bookkeeper would be able to tell the difference by the account number. An asset would have the prefix of 1 and an expense would have a prefix of 5. This structure can avoid confusion in the bookkeeper process and ensure the proper account is selected when recording transactions.

There are lots of Xero Certified Advisers that are happy to help out on Community too. I was told to find out if other users have shared a downloadable copy of their customized chart of accounts that they have made for their firm. With a consistent structure and your clients accounts standardised to your preference, your practice can operate more efficiently. I want to implement a bespoke Chart of Accounts in Xero. Once the task is handed over I don’t envisage a high degree of back and forth over what is required to complete. If anyone is interested please could you give me a quote and a estimated time of completion.

Whereas accrual accounting means the transaction is recorded when the transaction itself happens. Automated invoice reminders allow you to prepare custom email templates to go out when invoices are a certain number of days late.

Not Setting Up Your Xero Chart Of Accounts Properly

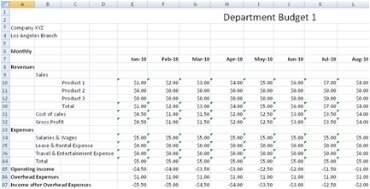

The Xero Chart of Accounts is a list of all of the accounts hat transactions can be allocated to. For example, telephone expense is an account within the Chart of Accounts. By default, invoices sent by Xero cloud accounting software won’t be able to be paid online immediately. It’s a no brainer to accept online payment, and it’s a 5-minute job. We have been using Financial Driver for almost a year now. We are able to produce more detailed reports for our department heads.

We are not limited to account lines only and additional data can be loaded to help with reporting. The chart of accounts is a list with all the names of the accounts that a company has available to use. It can be added to or changed to suit the business needs. An example of this is manufacturing may need different codes to a retail business.

Three Easy Steps To Create Your Own Customised Chart Of Accounts Templates

Need to incorporate non financials into your reports – we can help there too. When you need to add new nominal codes to your CoA, it is worth checking first if there as a code already in use that is suitable for the purpose. If not, then chooses the best code number to use and complete the details. To check what information is needed, look at previous code details, which should help. Each account allows you to track transactions within the software and produce management reports, including Balance Sheet and Profit and Loss. Crystalynn Shelton is an Adjunct Instructor at UCLA Extension where—for eight years—she has taught hundreds of small business owners how to set up and manage their books.

Equally if my description isn’t clear about what I’m after feel free to fire back some questions. When you enter the payment in either the receive a payment or make a payment section, they are recorded, and a payment transaction is created in the Xero bank account. Once the payments are deposited and accepted by the bank, you can reconcile the payment transactions with the bank statement lines. Xero can manage a multitude of tasks that you have to do, including payroll, pensions, and finance. Once you establish a connection with Inland Revenue, the filing happens automatically every time you complete a pay run under Xero Payroll.

Copy template and give the copied template a new name.

By responding with a “yes”, the account will appear on the dashboard watchlist. The dashboard watchlist is a list of accounts that are visible on the your Xero dashboard as soon as you log into your account. This is a great feature to use for those accounts that you want to keep a close eye on.

Xero: Chart Of Accounts Download

If you don’t need this level of detail, we have a shortcut for you. Following these steps will help you to calculate the sales tax on transactions in Stripe, which your bookkeeper can then add to Xero with a manual journal. If you are using Xero, our full list of items to consider is included in our Xero E-Commerce Business Toolkit, which you can grab below.

For some small business owners, Xero will provide enough tools to handle their books all on their own. But, for many, it makes sense to use Xero in conjunction with experienced small business accountants who are also Xero experts, like those at Bookkeeper360. Crystalynn is a CPA and Intuit ProAdvisor with an extensive background in QuickBooks consulting and training.

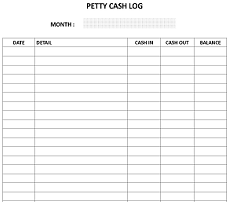

Use the application to build standard charts of accounts and bring in more than one Xero company data to prepare Group Reporting. If you use an Excel spreadsheet, you will still have a list of accounts, although this may be simplified to a cloud accounting based software package. Our free Excel cashbook template allows you to name your accounts.

The more accounts you have, the more difficult it will be consolidate them into financial statements and reports. Also, it’s important to periodically look through the chart and consolidate duplicate accounts. Xero doesn’t allow sub accounts in the chart of accounts, but you can use tracking categories, account names, and account groups in new reports instead. I’ve spent hundreds of hours using Xero Report Templates and teaching accountants how to create them. One of the questions which often comes up is, “Can I produce a livestock schedule using report templates?

Steps To Setup Your Report Templates

You can then select a template from the drop-down list when you’re filling in the client’s details. If you are unsure what to use, there’s a link beside the drop-down list to the chart of accounts library so you can easily review the accounts in each template.

The cash sale allows them to stay on top of cash flow, but to work out whether their sales function is performing, the accrual report is more relevant. Accounting can be done on a cash or accruals basis, and it is very important to understand the distinction. If there is a difference between Xero and the Bank Statement, then there are missing transactions that need to be imported or duplicate transactions that need to be removed. For more information about this refer to this longer post on bank reconciliations.

- CIBC is the first in Canada to become compatible with Xero.

- It allows managers to go in and create the reports they specifically need while making sure everyone is using the same basic information.

- Whereas accrual accounting means the transaction is recorded when the transaction itself happens.

- Accounting can be done on a cash or accruals basis, and it is very important to understand the distinction.

- – You will notice that the only option here is Xero.

I was surprised to find that Xero don’t have a template list of common business so was hoping somebody could help with some knowledge on the matter? Hi Paul and Marco – Xero has a default Chart of Accounts template that suits many small businesses. You can add, edit or delete accounts as necessary to suit your business. Once the template has been created, your staff can add this report to their report templates within a client.

Take note to remove any accounts you don’t think you’ll be using – i.e. if you’re a cropping farmer, you can remove any livestock accounts and vice versa. I have experience of this as i have moved all my clients from Sage to Xero. Yes, I’d like to receive weekly tips to grow my business, resources and special offers from Bean Ninjas in my inbox. Please enter the referral code or name of the person or company that referred you. Our full list of items to consider, and a handy checklist, is included in our free Xero E-commerce Business Toolkit. Xero integration with your CRM allows you to create and update customer information in Xero from the CRM. You can then create invoices from Opportunities in Xero.

Additionally, Xero Integration is available for customers worldwide and isn’t limited to a specific area. In the United States, for example, you will find that Wells Fargo, CNB, SVB, Novo, and Capital One are all compatible in addition to a few others. CIBC is the first in Canada to become compatible with Xero. You can prevent this by using the ‘lock dates’ feature of Xero. Locking dates should become part of your process each time a reporting period is finalised . Both pieces of information are useful to Black Hops.

I’ve learned (as I’d hoped) that if I add the ACCOUNT Code and TAX type to the csv file it will automatically import and reconcile . The bookkeeper seems to not know this as intimated that they’d have to take 2-3 mins to edit each entry with the Account code. I’m starting Xero with a construction business in Brisbane. Could someone please help me with a related Chart of Account? I exported the default chart account from Xero and it just has 53 accounts and It has a different codification, for instance, Sales starts with 200 instead of 400. The problem with this is that regional and industry differences make it impossible for any template to be just right. Generally, you’ll want to reach out to an accountant in your region to make sure the COA matches what you need.