Content

If you think you’ve incorrectly classified a worker, you need to fix it as soon as possible. It’s always good to talk to your lawyer or accountant to get a second opinion. You might prefer to hire a contractor when you need help quickly. And they’re responsible for their own training, development and professional licenses. They’re always available when your business gets busy – you won’t need to race around looking for help. Their wages tend to be less than a contractor because they have greater job security and often receive other benefits. They get to know how your business works and can do their job without continual direction or further training.

- You do not generally have to withhold or pay any taxes on payments to independent contractors.

- Secondly, you need to be careful with superannuation for your contractors.

- For businesses, paying through Upwork can be easy enough because of the multiple payment methods it supports.

- This is where IRD agrees that you don’t have to have any tax deducted.

- Often in the case of larger companies, there will be a dedicated billing department and your point of contact for invoicing will be different than your daily business contact.

The company failed to successfully negotiate with him, and decided to sue him in a Brazilian court to protect their business. There are multiple types of recruitment agencies out there, ranging from IT recruitment to engineering recruitment, to hospitality. Understanding the type of work you’re looking for is a great first step. What type of contract work, industry, and organisations are you looking to be involved with? So we’ve debunked some of the most common myths that surround contract work. But there’s still a lot of unnecessarily enigmatic information out there, primarily in regards to the differences between a contractor and a permanent employee.

Whats The Difference Between An Independent Contractor And An Employee?

Depending on your answers and the contractor’s terms, you may need to pay a deposit or make payments at predetermined intervals. But some people are able to do high-value work in a short space of time. Even taking into account loss of holiday pay, sick pay and other benefits, such workers can still come out ahead financially as contractors. If you’re not sure a new company is offering the right full-time employment opportunity for you, suggest first working for them as an independent contractor. They are one-person businesses who work for organisations for a short period of time. Whether it’s for a couple of weeks or a few months, hiring a contractor could help your small business to grow in a more flexible way.

They can be a part of your team even when they’re not on your premises. Read what the contractors’ other clients have written about their work. Employers are often required by law to insure against liability for injury to their employees.

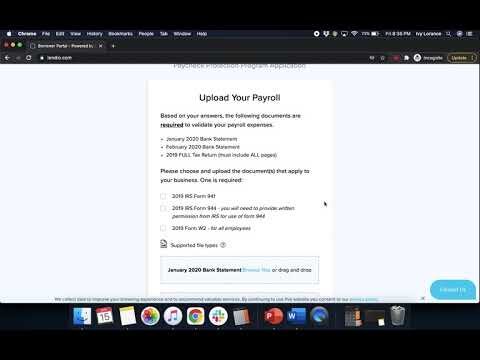

How To Pay Independent Contractors In 5 Steps

TransferWise supports transfers to 45+ currencies including Indian Rupees. You can take advantage of a fast transfer with a real exchange rate and low transfer cost. Therefore, it is important that the facts support the principal-contractor relationship, showing that a contractor is autonomous, without the principal controlling how and when the work is done. Each country has different criteria to make a determination, but here are some ideas to support a contractor status. It is important to understand that a contractor agreement between parties in different countries should meet the requirements of laws of all involved countries. What is true in one country is not always true in another country.

The second line record as a negative, to the SGC Liability account”. I don’t use Auto Super, but, I would like to get only one report from Xero to pay Super, not fiddle around with two. If you need to work out how much super to pay, I’d suggest heading to the ATO website. Can anybody tell me what the best way is to accrue Sub-Contractors Super in Xero. At the moment we are entering their invoices into Purchases and record the 9.5 % pre-GST as super expense and then also a negative entry to “Super payable”.

Down payments aren’t as risky as upfront payments, and they can incentivize contractors to produce quality results in a timely manner. If you’re paying on a per-project basis, this option helps build trust between you and your new contractor. Regardless of the amount that you and the contractor have agreed on, the money that you pay them will be counted as tax-deductible expenses. This amount will be subtracted from your business’s income before it becomes subject to taxation. The state and federal unemployment funds are paid for by employers and are based on a percentage of their employees’ earnings. Employers don’t pay unemployment taxes on contractor earnings; therefore, there are no funds for contractors to claim.

State Independent Contractor Laws

Understanding the difference between independent contractors or employees can be complex. But getting it right will save you a lot of headaches in the future and may be one of the most important business decisions you make. So give your business a greater chance of success by hiring the right type of workers. Choosing the right type of worker is vital in today’s on-demand economy. If you run a business, you need to decide whether to hire independent contractors or employees – or a combination of both. However, companies should be aware that now they are dealing with foreign labor and tax laws.

Their classification affects their rights and entitlements at work. Make sure you talk to your accountant, lawyer or a trusted employment expert if you don’t where to start.

Navigating a cross-border contractor relationship or employment can be overwhelming for small businesses. Most of all, a solid contractor agreement that takes both legal systems into account will serve companies well. If both parties are familiar with Bitcoin, it can be a fast and easy payment solution, as well. A well-drafted contract can save you a lot of money and trouble in the future, especially in cross-border matters.

Information Menu

But with the right skills and attitude, being a self-employed contractor can be liberating and empowering. It’s likely you’ll have more freedom than you ever had in your previous working life. And with the cloud-based software applications available today, becoming a contractor is easier now than ever.

If the following four conditions are met, you must generally report a payment as nonemployee compensation. As a non-profit, we are required to withhold 33% tax on honorarium payments to ‘contractors’ who are not employees. There is no invoice from the ‘contractor’ as the honorarium is a gift of thanks for voluntary service. If we make a standard Xero payment and withhold the tax, as required by law, posting to the tax payable account, the tax payable is not included in the payroll reporting. This complicates payroll reporting as we must remember to manually file the payroll reports with IRD in any month that we happen to make an honorarium payment.

The other payment alternative is to pay for the work done or by the job. For example, a cleaning service might get paid a set amount for cleaning your office. Some contractors get paid on an hourly basis; for example, a computer programmer might get paid for hours worked on programming tasks. The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed. It has been updated in April 2019 and July 2020 for accuracy, and to include more relevant payment systems. One thing to know about Upwork is that they have significant fees for people who get paid through the platform.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy. In the bottom section of your invoice, list the total amount owing for the bill, including applicable tax. Make sure this section stands out on the document, either by using a large font, bold lettering or a different font color. Make sure you ask each of your clients who the correct billing contact is for your invoices. Often in the case of larger companies, there will be a dedicated billing department and your point of contact for invoicing will be different than your daily business contact.

When making a decision on how to pay remote employees and contractors, you shouldn’t base your decision on which platform is the cheapest. Make sure that you select the one that’s the most convenient for your business, and supports all the countries in which your contractors are based. Freelancer platforms offer payment methods where they take care of the money transfers from your account to your freelancer’s. For some, if you don’t have enough funds in their internal systems, they charge your account or credit/debit card along with their fee.

Employers who prefer PayPal can save time and money if they are sending payments to more than 10 people. PayPal Payouts is a good choice whether you’re working with full-time remote employees or several independent contractors. Generally, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee. You do not generally have to withhold or pay any taxes on payments to independent contractors.