Content

The general ledger says he paid $81, but the check shows he paid $810. You can imagine how easy it would be to make mistakes recording the same transaction in two places. Accountants regularly conducted general ledger reconciliations to catch errors. This transaction results in the bank’s assets decreasing by $1,000 and its liabilities decreasing by $1,000.

If a check has yet to clear, contact the payee to learn why. If the check is still outstanding after a month, it may be lost. This is a fee charged to the company for any checks deposited for which the issuer did not have sufficient funds.

The Importance Of Reconciling

For example, if a company receives $900 on Saturday, June 29, the debit to the Cash account will show the date of June 29, even if the money is deposited in the bank account on Tuesday, July 2. Since the adjustments to the balance per the BOOKS have not been recorded as of the date of the bank reconciliation, the company must record them in its general ledger accounts. These are the checks the company had issued and recorded in its Cash account, but they have not been paid by the bank as of the date of the bank reconciliation. Compare every amount on the bank statement (or in the bank’s online information) with every amount in the company’s general ledger Cash account and note any differences. Once it is established that the bank reconciliation statement should be made, it is then important to identify the type of differences that exist between the bank book and the bank statement. To prepare a bank reconciliation, it is important that both the bank book and the bank statement of the business are available.

Vyapar auto bank statements will minimize the time spent & the risk of errors during the bank recociling. Bank statment in Vyapar provides a simple and no-frills method of reconciling your company bank books with the bank statements. Unrecorded differences will be adjusted and recorded in the bank book and timing differences will be adjusted against the bank statement balance.

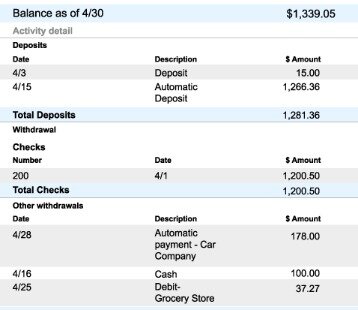

When you’re completing a bank reconciliation, the biggest difference between the bank balance and the G/L balance is outstanding checks. Most business owners receive a bank statement, either online or in the mail, at the end of the month. Most business accounts are set up to run monthly, though some older accounts may have a mid-month end date.

This means that the check amount has not been deposited in your bank account and hence needs to be deducted from your cash account records. Similarly, the bank too keeps an account for every customer. In the bank books, the deposits are recorded on the credit side while the withdrawals are recorded on the debit side. The bank sends the account statement to its customers every month or at regular intervals. If you’re interested in automating the bank reconciliation process, be sure to check out some accounting software options.

If the amounts don’t match, you need an explanation for the difference. Performing regular bank reconciliations helps ensure your accounts are accurate before a major mistake hurts your finances. Deduct the balance of outstanding cheques from your account that haven’t cleared yet. In your records, you’ve already recorded that you’ve made payments.

You will also need to adjust your records to accurately reflect all of the company’s transactions. You’ll do this by making sure that all charges and deposits are accounted for in the company’s cash account. Check your books against the bank statements, and make sure that every transaction is properly accounted for. Perhaps a payment has yet to clear or you forgot that you paid cash for something. To reconcile your records, you will need access to a list of your transactions. You can get this information through online banking, a bank statement or by allowing your bank to share data with your accounting software.

- One possible error comes from “transposing,” or reversing the numbers on a deposit amount or check.

- To compare beginning and ending account balances, look at your company’s adjusted trial balance from the previous accounting period and the general ledger from this accounting period.

- If you’re not the only person with access to your business funds, you should match approval documentation to each transaction.

- This may require going back several months in order to find the issue, which is why reconciling each month is so important.

- Add deposits that do not yet reflect on the bank statement as an adjustment to the balance.

When you use accounting software to draft financial statements, you shouldn’t have to do another GL account reconciliation… until next month. As you know, the balances in asset accounts are increased with a debit entry. Therefore, when a company receives money , the company debits its general ledger asset account Cash and credits another account using the date that the money was received .

When it takes more time to find and reconcile discrepancies, there may be larger issues that need to be addressed. An automatic electronic payment might clear your account a day before or after the end of the month, and you might have expected to see it in a different month. Amy Drury is an investment banking instructor, financial writer and a teacher of professional qualifications. She has been inspiring Wall Street professionals and authoring textbooks for 20 years. A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370. If you identified a missing transaction in your books, record a journal entry as if you hadn’t missed it in the first place. For example, I discovered someone incorrectly recorded payment from a customer named Travis.

How Often Should You Reconcile Your Bank Account?

Product Reviews Unbiased, expert reviews on the best software and banking products for your business. A regular review of your accounts can help you identify problems before they get out of hand. When you can easily account for discrepancies, there’s probably no need to worry.

Since the adjusted balance for both the bank book and bank statement is $400, it means there are no extra items that need to be reconciled. These are differences that exist in the bank statement but are not recorded in the bank book.

How Bank Reconciliation Works And Why It’s Important

A vendor reconciliation statement is prepared to ensure that the accounting entries passed in the books of the vendor are in line with the accounting entries passed in our books. For errors in the bank statement, the bank is contacted and details are given about the transaction. Any difference that is not an unrecorded difference or a timing difference is an error. As previously mentioned, errors can occur on both sides, the bank book or the bank statement. As discussed above, the differences between the bank book and bank statement of a business can be classified into two categories, unrecorded differences and timing differences. The business has to identify any differences between the balances in these two documents and reconcile them in order to ensure proper control over it bank balances.

These might be either due to unrecorded differences or timing differences. If an item appears only in one place , it is a “reconciling item”. Your goal is to identify the reason the two records don’t match, and correct them until they do. Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer.

Mostly, errors occur in the bank book of the business rather than the bank statements. These errors are then investigated properly to ensure they were not committed intentionally. These differences are adjusted against the bank statement balance but are not recorded in the bank statement. These are differences that will appear in the bank statement after some time, most probably in the next bank statement. Therefore, once the business gets the bank statement and identifies these differences, these are recorded in the bank book of the business. Unrecorded differences, as the names suggests, are differences that are not recorded. These are differences that are recorded in the bank statement of a business but not in the bank book of the business.

This is probably the most important step in the entire bank reconciliation process. You can also build protection into your bank accounts, and your bank can provide useful ideas. If you’re familiar with balancing your checkbook, then you’re already familiar with bank reconciliation. You’re essentially doing the same thing for the same reason. Justin Pritchard, CFP, is a fee-only advisor and an expert on banking. He covers banking basics, checking, saving, loans, and mortgages. He has an MBA from the University of Colorado, and has worked for credit unions and large financial firms, in addition to writing about personal finance for nearly two decades.

Step 3: Compare Checks And Adjust Bank Total

Before the reconciliation process, business should ensure that they have recorded all transactions up to the end of your bank statement. Businesses that use online banking service can download the bank statements for the regular reconciliation process rather than having to manually enter the information. Subtract outstanding checks from the balance shown on the bank statement. The journal entries must be prepared for the reconciling items on the adjusted book balance . Adjustments to increase the cash balance will require a journal entry that debits Cash and credits another account.

An error can also occur when a check or deposit is lost. With the proliferation of automated bank reconciliation features from accounting system apps, sometimes all it takes is one wrong click of a button to make a transaction go wrong. In other cases, reconciliation issues may identify the need for different business partnership payment terms, banking options, or withdrawal protections. These are the following benefits of automating the bank reconciliation process using accounting software. Now, start a bank reconciliation statement with updated cash book balance.

Keep a tick against all items that appear in both the records. The entry records for the customer will show the cash deposit in the bank, the amount will be debited from the cash balance and will be credited to the bank account. These differences can be classified into unrecorded differences or timing differences. Bank reconciliations are performed by comparing the balances from the bank book and bank statement and identifying differences and the types of those differences. Bank reconciliations are an important part of a business’ internal control system. Bank reconciliations must be performed to find the differences between the bank book balance of a business and its bank statement balance.

Contact your bank and ask them to make a correction to remove the reconciling item. Make sure to check the prior month’s statement as well to ensure that any outstanding checks from the previous period have cleared this month.

Bank reconciliation done through accounting software is easier and error-free. The bank transactions are imported automatically allowing you to match and categorize a large number of transactions at the click of a button. This makes the bank reconciliation process efficient and controllable. An NSF check is a check that has not been honored by the bank due to insufficient funds in the entity’s bank accounts.

Adjust The Cash Balance

The process can help you correct errors, locate missing funds, and identify fraudulent activity. When you reconcile your business bank account, you compare your internal financial records against the records provided to you by your bank. A monthly reconciliation helps you identify any unusual transactions that might be caused by fraud or accounting errors, and the practice can also help you spot inefficiencies. Refers to the deductions in the bank statement which are not yet reflected in the books of the company. Another examples of this are bank service charges, cost of checkbooks, processing fees, and bank collection fees. In accounting, a company’s cash includes the money in its checking account. To safeguard this critical and tempting asset, a company should establish internal controls over its cash.

If you deposit funds at an ATM or at the bank branch, the delay may be brief. If there is an undocumented reconciling item, review the bank reconciliation process steps just noted. If there is still an undocumented variance, go back to the bank reconciliations for the preceding periods and see if the variance arose in a prior period. If so, investigate the earlier periods to locate the difference. The May 31 deposit of $2,000 has yet to be processed by the bank, so it is missing from the bank statement. Make sure that all of your bank deposits and withdrawals are accounted for in your bank statement.

For each of the adjustments shown on the Balance per BOOKS side of the bank reconciliation, a journal entry is required. Each journal entry will affect at least two accounts, one of which is the company’s general ledger Cash account. Compare every amount on the bank statement (or the bank’s online information) with every amount in the company’s general ledger Cash account and note any differences.