Content

With a larger variety of payment options, it is easier for customers to pay you. You should reconcile weekly, if not daily, to ensure that your accounts are as accurate as possible. The next step is to set up your bank account feeds, including credit card and PayPal accounts, if you have them. If you have an accountant, you can seek their help with this decision.

Xero is an online accounting software designed for small businesses. If you’re new to Xero, then this guide to getting started should help you quickly get up and running.

Helping UK businesses to grow and meet their financial reporting obligations since 2003. Take a look at our ‘what we do‘ and ‘the numbers that matter‘ pages for more information. “Working in the cloud also gives us a great opportunity to support and help clients who process their own payroll on Xero – we can remotely log in to their Xero and help whenever required,” adds Linda. That would just be the current balance of your Super Payable account – although agree there is no Super report that combines the “Super Accruals” with “Super Payments” report – so you can see eg per Employee the balance.

I was able to work from home pretty easily and run payroll seamlessly with Xero – clients saw no disruption. But for the payrolls on Sage, we had to run that through desktop software off-server, through a VPN, which got really slow and clunky. We decided that we had to make the move to Xero for as many of our clients as we could so that we could maintain an efficient service for them. Our workload had increased substantially with furlough calculations and claims, so we had to make sure that we were being as efficient as we could be. The main software used for processing client payrolls was Sage – but Linda saw the potential for Xero to improve things dramatically.

The numbers are correct when it comes to employee fixed monthly payroll (even though the presentation on payslips is a little confusing to everyone as the rate & units each month change). The main benefit of using the Xero software is that you can benefit from being able to manage everything in one place; from your accounts, running payroll and doing things like pensions too. Xero was founded in 2006 in New Zealand, with the plan to create innovative software which is cutting-edge and helps business owners and accountants manage things like accountants and payroll. It’s the number 1 cloud accounting software and MTD compliant.

The drastic price jump from $11 to $32 a month means Xero isn’t particularly scalable—another reason we’re more comfortable recommending it to midsize businesses rather than small ones. At GetApp, our comprehensive software listings, verified user reviews, product comparison pages, articles and AppFinder, our assistive tool, will empower you to make confident and well-informed purchase decisions. As users go about their daily business, the Xero team are busy providing constant improvements to their service, adding small adjustments and new features on a constant basis. New features are added every 3-6 weeks to ensure that the efficiency of the app and your user experience are always at the most optimal level. Support can phone it in when you first reach out to them, but if you set up a time to chat with someone they are extremely helpful. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

Start Using Xero For Free

I am training a new Xero client this afternoon and this is going to be embarassing as I am not going to be able to show them how to reconcile the bank payments to the payrun. 12) Follow the process for the remaining employees and you will have reconciled all wages. Have you already applied the payment for the full amount to the Purchase?

@Joel – It sounds like the 804 account in your organisation might be a system account that’s been overridden. If that’s the case, can you please get in touch with Support so they can give you a hand with this one. Paul, we did hear overwhelming feedback that most users wanted their Payroll to be integrated with their General Ledger – which is why we made the change.

When you enable automatic enrolment in Xero, eligible employees are enrolled in your workplace pension, and contributions are deducted from their pay. Xero sends data directly to Nest or The People’s Pension, or lets you submit a file to another provider. Simplify compliance with HMRC reporting requirements. Firstly, insert the expense amounts that will show up in the profit and loss report on Xero. If you really want to get things posted onto Xero correctly then the Gross Pay amounts should be split up onto different expense codes on Xero. Your accountant will show the split in the full statutory accounts that are created for HMRC purposes. Also, splitting the two provides meaningful and useful information when reviewing your interim management accounts reports on Xero.

The issue is that there does not seem to be any method of notification when each anniversary date comes around. Currently we are relying on “calendar notifications” from external sources such as Outlook. If an anniversary date is overlooked, it can create issues for both employer and employee. With some employers having quite a few apprentices and all with varying anniversary dates, it can get a bit “messy”. Ideally, it would be good if the anniversary date triggered a “block” on processing a current payroll until the anniversary date is updated, thus ensuring no errors are made. While these online reviews aren’t always accurate, they should still be considered when deciding whether you should opt for this payroll software.

Xero Reviews

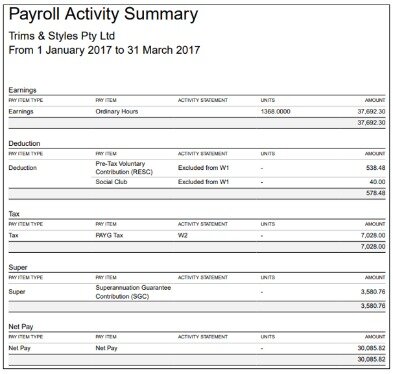

However, if you are your own bookkeeper then we recommend using Xero’s default chart of accounts. You can add, customise, or delete these accounts to match the needs of your business. Use Xero’s payroll software to simplify compliance with Inland Revenue requirements. This said, if reconciling in this way makes no difference to tracking that pay – eg. If I can do a report against that project and find how much has been spent on each staffs’ wages for that project without reconciling in that way, then great. You can set up a bank rule in your reconciliation to reconcile direct to your Wages Payable account. Thanks Joy – It is reflecting Gross Wages, and I am trying to reconcile it to the Payroll Activity summary which shows gross earnings.

At the moment, there is no payroll report that shows you what superannuation contributions you have paid. This is a feature that we have on our radar, however as yet there is no definite date.

Xero Payroll: Revolutionise Payroll By Moving To The Cloud

In this review, you’ll find out everything you need to know about Xero payroll, including who they are and what they can offer you. All pricing plans are in GBP excluding VAT and cover the accounting essentials, with room to grow. “As a cloud based account system its is as good or better than other tested. It has all functionality needed and does not break the bank for the features.” AbacusLaw is flexible and dynamically scalable to support legal professionals from solo practitioners to enterprise law firms from client intake to payment. Zola Suite is the fast-growing solution for small and midsize firms that want to eliminate data silos with an end-to-end, cloud-based practice management solution. I truly wouldn’t be able to run my business without Accounts Lab.

If the payee is based in a foreign country and using a different currency, Xero will undertake the task of automatically converting the invoice into the currency used by the client. This means that you never have to worry about calculating exchange rates. Xero covers over 160 currencies and automatically updates exchange rates every hour. There is more information in the project tabs than what you can obtain in the report which is disappointing.

Whilst I’m great at the marketing and the sales side of running a business, I’m just not a numbers guy! Accounts Lab along with Quickbooks have changed the way I look at an accountant. We’ve been with Accounts Lab since the very beginning of our business. Seed EIS, R&D and implementing an online cloud bookkeeping system through Xero – Accounts Lab has undoubtedly helped us grow our business. The integration of artificial intelligence is another trend we expect to continue in 2021. Payroll AI is able to pick up on errors that can lead to fines.

Thought i must be doing something wrong, have looked at the how to do a pay run help section and it refers to anything before August 18 but what after this date please. Any pros/cons with using the staff members’ names for “Name” when creating the transaction to reconcile, as opposed to using “wages” for the name? I figured out how to do it before I saw the above linked video recommending “wages” for the name. Go to create tab enter “wages” under Name and Description account 804 and click OK. 2) Return to Payroll Post Pay Run and click on the date of the pay run. Secondly, insert the liability amounts that will show up in the balance sheet report on Xero. These are amounts that the company owes to other parties .

Many small businesses already use a number of other systems such as CRMs, inventory management tools, time trackers, receipt scanners and so forth. Importing all this data from multiple apps to Xero can seem like a daunting task, however this is made hassle-free through the some 500 plus add-ons offered on the Xero Marketplace. The Xero dashboard is where business owners can get a complete picture of their key accounts, income and expense reports, upcoming bills and pending invoices. This feature provides a valuable overview that gives users a clear understand of all their company’s financial activities in a glance. Moreover, certain accounts can be watch-listed and monitored in greater detail by enabling notifications.

Xero is an online accounting software suite that utilizes a modern cloud network to fully accommodate the complete range of accounting needs. The app allows you to coordinate and manage all financial processes within an easy to use platform, accessible from all internet-enabled devices. View a wide range of payroll reports to get valuable information on payroll activity, transactions, leave balances, timesheets, remuneration and superannuation. For some reason, I am not able to reconcile the P&L wages to the Payroll Activity statement, and all transactions for the fortnightly payroll are not showing up at all on the P&L.

In other words, if your business is big on financial collaboration, it’s hard to do better than Xero. Keep reading—our Xero review lets you know if the software’s price, features, and support match your business’s needs. The online invoicing system can issue invoices for payments that come from PayPal accounts, bank transfers or credit cards, with no country-related exceptions. One of the key features of Xero’s invoicing tool is the notification system that alerts you when your invoice has been opened by the recipient, eliminating any confusion over “lost invoices”.

- Id rather pay for a decent product than use a “free” that doesnt actuall work like every other payroll platform on the planet.

- This means there is no longer the need to create a draft bill when a pay run is posted.

- Xero is a cloud-based small business accounting software with tools for managing invoicing, bank reconciliation, inventory, purchasing, expenses, bookkeeping and more.

- This is the account you’ll need to use when reconciling the wage payments from your bank account.

- We do have plans to improve the Payroll reconciliation process and Community is the best place to add your feedback on what these improvements should be.

the riduculous payroll module and it deficiencies is why i just switched to quickbooks online for all 3 companies after 3 years with xero. but it actualy does what a payroll service is suposed to do. if you use the desktop version of QB its actually cheaper than xero and you can use three EINs for 30 a month. Id rather pay for a decent product than use a “free” that doesnt actuall work like every other payroll platform on the planet. If manual then the easiest way to reconcile your payments out of your bank account is to create a bank rule for payroll to go to 804. Hi, Josh H, the above help centre link doesn’t work anymore – can you please confirm where i can find this info?

Small Business

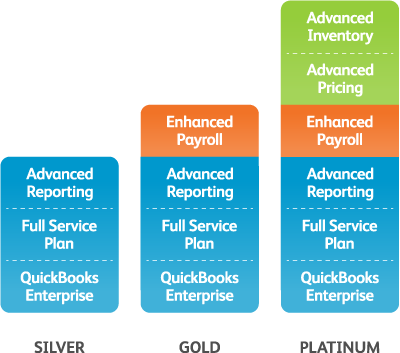

You would need to run either a superannuation accrual or superannuation payment report to identify your employee accruals and then reconcile against your payables account with any payments you have made. Xero could be an excellent fit for companies that require a comprehensive piece of software which can help you with anything from accounts, to payroll, to dealing with things like inventory and invoices. Prospective users should consult the official pricing page of the corresponding Xero website for their location. In general, Xero is offered through 3 different plans. The most basic is the “Starter” plan that costs $9 per month and is limited to five invoices, five bills and 20 bank transactions. The layout of the dashboard makes it easy to use and navigate, while the intuitive graphs provide a visual understanding of key data that helps users compare account activity in a more tangible way. The dashboard not only displays data, it also allows you to perform tasks such as adding accounts, bills and issuing invoices by clicking on the corresponding buttons.

Are you a Xero user looking to take your cash flow forecasting skills to the next level? Download our advanced guide for free and find out how cash flow forecasting can help you to make the best decisions for your business. Initially, when you’ve input some data, look at your Balance Sheet, Profit And Loss, Aged Receivables, and Aged Payables. Only set up payment reminders when you get into the habit of reconciling receipts daily. Chasing payment from customers that have already paid can tarnish your reputation.

ie, you may have set up Monthly payments on the 28th of the following month. I have put these details in the notes, but it can be annoying to try and find/remember what year and anniversary dates are for multiple employees. I was wondering if it would be possible to include a new field in “employment” details for employees. We have a number of clients who have quite a few apprentices and as each year passes, their pay rates increase, normally from 1st year through to 4th year apprentice.

I have used so many different platforms, and Xero has been the easiest and most reliable software I have found. Regularly updated invoices give you a clearer picture of cash flow. With a clear picture of your cash comes the ability to make better business decisions and avoid falling behind on outstanding payments. Just a few minutes a week spent approving pre-matched items ensures your data is up to date. As Xero is connected to your bank, transactions are pulled through automatically. Xero remembers the last time you categorised a transaction, so you can simply click ‘OK’ if you want it to go to the same category. Simplify compliance, automate calculations, and pay your employees the correct amount, every time.