Content

Processing JobKeeper for April Pays that have already been processed in Xero. Things are a little different this month so we’ve put togethera summary of what businesses need to know. If you want to outsource this to an accounting expert, contact us for assistance. Both you and the nominated employee need to complete the form. It is just a document you retain to prove that your employee has agreed that you claim the JobKeeper Payment for them. You only need to satisfy the fall in turnover test once – you don’t need to test your turnover in the following months or quarters. If you are a registered charity, the decline in turnover must be 15% or greater.

It’s a more intuitive way to connect and chat all things business with one another. Ask questions, dish out answers, and get involved. If you have stood any staff down after 1 March, you can choose to reinstate them and pay them the $1,500 JobKeeper subsidy. tool to help assess your fall or increase in GST turnover.

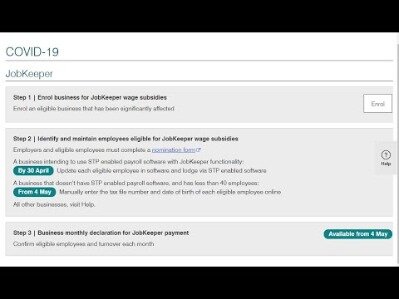

It will still apply only to eligible employees who were with you before 1 March. You may remember that in your original application for JobKeeper, you had to document a one-time drop in business revenue of at least 30%. It only applied to eligible employees who were with you before 1 March 2020. To receive the correct JobKeeper subsidy payments from the ATO, pays will need to be processed correctly in Xero before you make your Monthly Declaration . The next Phase is to enrol your eligible employees in Xero for JobKeeper.

Phase 7: Setup Jobkeeper Income Account In Xero

If your eligible employees are already earning more than the required minimum JobKeeper amount, there will be no need to do a top up for them at all. Just make sure that you have entered their JobKeeper start fortnight so the ATO knows who you are claiming for. Hi Louise, you don’t actually need to pro-rata the amount of the JobKeeper payment for your eligible employees, as this is based on the payment date of your pay period. So you would just need to make sure your eligible employees are paid the $1500 per fortnight for each pay period where the payment date falls within the JobKeeper periods. Say I have a fortnightly pay period that goes from 19 March – 1 April, and my payment date for that period is 2 April. And I would top them up for the entire JobKeeper amount ($1500 per fortnight), not just the 3 days that my pay period overlaps with the JobKeeper cycle. For your scenario you would pay them as normal for the hours they have worked.

We will be updating this Xero Central article with new resources and step-by-step written instructions once our new JobKeeper feature is released. Keep an eye out for any changes here, or in payroll.

If you need some more information on how to do this in Xero, we have a page in Xero Central that walks you through how to process JobKeeper payments. If you need some step by step instructions on how to do this, the Xero Central page on processing JobKeeper payments in Xero should help you out here. If we want to pay our employees the Jobkeeper allowance early, do we jucst create an allowance called ‘Jobkeeper Allowance’? the Xero team will go through the JobKeeper 2.0 scheme, unpack how to process JobKeeper payments in Xero Payroll and provide plain language examples to support you. If an employer is claiming JobKeeper 2.0, it must be lodged for all eligible employees (there’s no picking and choosing). The scheme has been extended from 28 September 2020 until 28 March 2021.

It’s ok if the September 2020 BAS isn’t yet lodged. Likewise, when retesting for the October to December 2020 period, the December 2019 BAS will need to be lodged. Here is an example our suggested process for entering a JobKeeper Top-up payment where 40% is to be Salary Sacrificed into their usual MEA Liability account. What should we do as we don’t qualify for Jobkeeper this month for the 1st time since it began but we may qualify again next month. Do we need to end all employees currrently registered for JK and then re-start or can they all sit there as eligible.

The details of these employees will flow to the ATO when you process pays and file with the ATO using the STP function. Eligible employees must be selected in Xero regardless of whether they will receive a Top-up payment or not. Once you have determined and have the correct documentation for the eligible employees, you will need to identify them in Xero. You need to reconcile the statement line in Xero to a receive money transaction when you receive the JobKeeper payment from the ATO. You can find more information on how to process JobKeeper payments in this Xero Central article. If an employer decides to put one of their eligible employees on JobKeeper, they have to put all of them on.

You can start making JobKeeper payments now by setting up an allowance pay item to pay your employees. The Xero Central instructions are useful in explaining how to do this right now.

- Reconcile the JobKeeper payments from the ATO to this account.

- It only applied to eligible employees who were with you before 1 March 2020.

- If you need more time, you have until the end of May to enrol and identify your employees.

- Hi everyone, Come on over to the new discussions in Xero Central.

- In the spirit of reconciliation, we acknowledge the Traditional Owners of Country throughout Australia and their connections to land, sea and community.

- JobKeeper 2.0 payments for employees will depend on the total hours worked during a specific period, with employers assigning each nominated worker to one of two tiers.

So would these employees loose out on payments if I dont top up before confirmation, or can I after confirmation top up their pays. I was told that the ATO will be prepopulating the jobkeeper payments. Does this mean we generate the payrun but don’t file with ato under STP. Xero Payroll helps you process JobKeeper payments you’ve made to workers, including those made before JobKeeper was passed by Parliament. The software creates a pay item so that you can accurately report these payments to the ATO.

How To Process Payroll Within Xero For Jobkeeper Payments

Hi Sam, in this scenario no, you won’t have to complete any additional top ups for your employees. We have written up a few example scenarios that walks you through what would be required for JobKeeper top ups in Xero Central which should give you some additional guidance here. Hi, could you please advise if you use STP in xero do we need to apply to the ATO for jobkeeper? or will they use the FN01 when filed as application for Jobkeeper. I am just applying for JobKeeper today and have nominated employees for eligibility though Xero. I’m a little confused as how to enter the gap amount for those employees working above the $750/wk.

As mentioned, we are also working to make this process simpler for you in the longer term. Soon you will be able to easily update those pay items so they are reportable through STP.

Hi Julie, yes you can reverse out any JobKeeper payments that you have previously processed so that you can use the required JobKeeper pay item. We have instructions on how to adjust previous JobKeeper payments in Xero Central to help you out.

Enter the number of hours the employee worked at their regular rate/s. Hi Andrew, when registering for STP, you would opt in through Xero, and will be directed to a couple of different options for contacting the ATO to complete your registration. There are also some instructions on Xero to help walk you through how to set up Single Touch Payroll. I have been told that the super is only optional on Job Keeper top ups or if the employee has been stood down.

Au Payroll: Jobkeeper

In order to receive the subsidy, all payments for fortnight 13 need to have been paid by this date and the monthly declaration made by October 14. Update the Pay Templates for employees who are entitled to JobKeeper Top-up payment.

However, when processing it in Xero, the JobKeeper allowance does not actually accrue leave. As these scenarios can get quite complex, we have put together a page in Xero Central that walks you through the different scenarios of paying your staff JobKeeper payments. This should help you work out which pay items to use, and how much to pay them with the JobKeeper top up allowance pay item. Is the whole amount – $1500 to be not shown as “Jobkeeper top up allowance” or only that topup part where the ordinary wages for that pay period is less than the $1500. Iam asking this also as the setup on the Jobkeeper top up is PAYG & Super Free.

Hi Anita, in Xero if your business is not eligible for the JobKeeper extension, all you will need to do is set an end fortnight for your nominated employees, then you can continue using payroll as normal. If you do have further questions about what this means for your business, we recommend reaching out to the ATO for further assistance.

I have a client where their employees are not eligible for the JobKeeper extension. Employers don’t need to reassess employee eligibility or ask employees to agree to be nominated by them as their eligible employer if they’re already claiming for the employees before 28 September. When you file your next pay run, Payroll will assign the correct codes to the eligible employee. These businesses would have BAS Excluded tax rate assigned to ALL transactions by default, including their trading income.

This will make sure that superannuation, plus any benefits such as leave accruals are still calculated on those hours. Then you would top them up to the minimum $1500 per fortnight using the JobKeeper allowance pay item. This pay item will not accrue leave, but can incur superannuation payments (if you set it up like that – we have set it by default to be exempt from Superannuation Guarantee). For employees that have been stood down, they would still accrue leave like they normally would, but would also be paid the JobKeeper top up. The portal to register for JobKeeper is available now with the ATO. This is where you will initially put in details of your eligibility for your business and your employees.

Eligible employers who have stood down their employees before the commencement of this scheme will be able to participate. Employees that are re-engaged by a business that was their employer on 1 March 2020 will also be eligible. Under the JobKeeper Payment, businesses significantly impacted by the COVID-19 outbreak will be able to access a subsidy from the Government to continue paying their employees. If you pay your employees weekly you can keep the same pay calendar, you just need to make sure you pay a minimum of $1500 ie $750 per week. Hello, Can someone please help me with a step by step guide in changing an employees Job Keeper END DATE so I can process his final pay. He has resigned and has never needed the Job Keeper even though all our employees were registered for it.

Practical Guide To Jobkeeper For Employers Using Xero

So for your examples, assuming what you have quoted here is the payment date, you would pay the full $1500 for the period where your payment date was 6 April and continue on from there. The JobKeeper fortnights are actually based on the payment dates of your pay periods, not the timeframe of your pay periods. And you would pay the full amount of the JobKeeper payment for each of your pay periods, not a pro-rata amount based on how long your pay period overlaps with the JobKeeper cycle. We have some helpful resources on Xero Central that walks you through some of these scenarios and step by step instructions on processing JobKeeper payments in Xero. As this can be a bit confusing, we have put together some resources in Xero Central to help you out with this. You can see some different scenarios to help you calculate how much to pay with the JobKeeper pay item and also, step by step instructions on processing the JobKeeper payment in Xero.

For example, maybe you terminated employees and then rehired them. Or perhaps you made JobKeeper payments early, in the expectation of being reimbursed. We’ll update these support pages as we learn more. As JobKeeper payments are made to your business, they will need to entered into your accounting software. One chief eligibility criteria is that businesses must have paid workers at least the minimum $1,500 fortnightly wage subsidy payments throughout April . list of your employees who are likely to be eligible for JobKeeper payment. And the decline must be quarterly, whereas at JobKeeper’s launch, you had more flexibility in choosing a period.

We have some examples available in Xero Central which walks you through the frequency of JobKeeper payments, depending on the payment cycle your pay calendars are on which should hopefully help you out some more. And here’s some helpful information from the ATO about paying your eligible employees. When your eligible employees are earning more than the JobKeeper minimum amount, just pay them as normal. Hi Holly, no there is no need to add the JobKeeper top up allowance to your eligible employees who are earning more than the minimum JobKeeper amounts. All you need to do is make sure you have set a JobKeeper start fortnight for them so the ATO knows you are claiming for those employees. Then all you have to do is just pay them as normal and file with STP. Here are some helpful resources in Xero Central which cover these scenarios to help you understand how to calculate the JobKeeper payments for each of your eligible employees.