Content

The main benefit of doing it this way is that it leaves an audit trail. When the employee submits a leave form through the Xero portal it only allows the employee to do whole days. Unfortunately at this stage this is the only way to do leave forms that are not full days. Hopefully Xero will bring in an upgrade to this soon.

I have entered hours under ‘opening balance’ as these were the hours accrued prior to XERO. Can someone please let me know how often the leave accrual is calculated?

We also use cookies set by other sites to help us deliver content from their services. The scheme also covers associated furlough costs for the employer’s national insurance and minimum pension contributions. Furlough employees won’t be able to work, but they’re free to do training, volunteer for frontline services or support those in need during COVID-19. Use Xero’s payroll software to simplify compliance with Inland Revenue requirements. Add employees to Deputy and they’ll automatically appear in Xero – and vice versa.

When this happens your employee’s leave balance will not reduce when you run payroll. To fix this, you must manually adjust the employee’s leave balance to reduce it to the correct number of hours owed. It would sound that you have set the accrual up based on a 7.6 hour day. Fair Work Australia state that employees are only to work a 38 hours week. The biggest addition in this update is that you can now set up an employee’s annual leave balance to display the amount of leave they can take in advance. View a wide range of payroll reports to get valuable information on payroll activity, transactions, leave balances, timesheets, remuneration and superannuation.

The Best Way To Adjust Leave Balances

The Leave settings are “locked” and don’t have an option to change the calculation method. Please get back to me ASAP, i need to change this now.

Here, we can see that Odette has 27.0574 hours of annual leave accrued. Through the employee portal, staff can submit leave requests online, which managers can approve. Payroll administrators can then review the leave in Xero, before creating and processing the pay run. In Xero staff can create and submit timesheets from their online employee portal which managers can login and approve. Payroll administrators can also create Timesheets on behalf of employees before processing the payrun. Part of your employer responsibilities is paying employees at the rate specified in the employment agreement.

Simplify Everyday Business Tasks

For 152 hours they should accrue 2.9230 hours a week . The only time leave does not accrue is on unpaid leave. it clearly states that leave is calculated on Ordinary time earnings, this is clearly not the case and has resulted in employees receiving less leave than they should. If an employee is entitled to sick leave, it will need to be set up in their Pay Template once the leave type has been set up in the Payroll Settings. For more info on setting up leave accruals, check out the Help Centre link here. We need to pay a permanent employee 7.5 hours of sick leave. We added a new line under “personal/carer’s leave” is that correct?

Once approved it automatically adjusts his accrued hours and puts a leave line in under wages paid and for the hours of leave and the ordinary worked hours are automatically adjusted. You should have set him up for both annual leave and personal leave accrual. I am also having issues understanding Xero payroll hours and holiday accumulated. After 6 months on the job, the employee goes from 80hours, then 88, then 104, then 112… it increases 8hrs, and sometimes 12hrs. Plus i need to understand how the $ of holidays come about too, it does not add up on my maths. Give your employees online access via web browser or smartphone and reduce your payroll admin. Set up Xero payroll so paying employees takes just a few clicks.

Is this something that has a systematised fix, or is there an update that will address this? Hey Team – Yes, with monthly employees, the system will divide the number of hours in a monthly pay period by the number of business days in that month. @Neil – It sounds like these leave accruals are set up to be a fixed amount per pay period. If this method is used, the accruals won’t reduce when unpaid leave is processed. The recommended calculation method is ‘Based on Ordinary Hours’. This way, they’ll take into account unpaid leave, as well as employees who are part time. The amount of hours will change each period due to the number of working days in the pay period.

Always Act In Good Faith And Treat Employees Fairly

Time off is essential for your employee’s health and wellbeing. When they’ve had a break from work, they come back more focused and productive. Understanding the different types of leave and holidays and the rules around them can help you better manage leave for your staff and keep them happy. Income tax is one of the deductions made on an employee’s salary or wages. Be sure to deduct the right amount for each pay period based on your employee’s earnings.

Payroll data feeds into Xero accounts automatically. Simplify compliance, automate calculations, and pay your employees the correct amount, every time. Once you have adjusted and checked Odette’s numbers, save the pay template and post the pay run. Odette’s annual leave pay out should now be complete and her annual leave balance should have reduced.

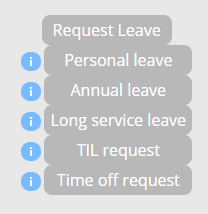

How To Manage Leave In Xero (australia)

I would suggest lodging a support request with Xero so that they can look at how you have set up the accrual. It needs to be set up as if it is for a full time employee and based on ordinary hours and then Xero calculates the pro-rata accrual. Remember when setting up the accrual for part timers that the hours accrued annually field must be the hours for a full time employee. Xero will calculate the pro-rata accrual based on the hours they work.

My other option is to ditch Xero payroll and either use Keypay and Xero or the Keypay integration with Quickbooks Online. If this much work is required just to calculate leave, the advantages of Xero diminish quite quickly compared to our previous spreadsheet approach. In the employee pay template, I’ve tried “Calculate Rate – Fixed Amount Each Period” and “Calculate Rate – Based on Ordinary Earnings”. If I choose one, accrual may work as expected but not taking leave. If I choose the other, leave subtracts the appropriate amount, but accrual is not correct.

Employees may be entitled to other types of leave such as bereavement leave, parental leave, jury duty, and more. They may also ask to take unpaid leave, and it’s up to you as an employer to allow this or not. Consider your employee’s reasons and discuss the best approach with them. Payment for annual leave is usually at the rate of daily pay, but it may also depend on other rules prescribed by employment law.

- We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

- When you allocate leave to the employee select fixed amount each period.

- I have the same issue, the accrual is correct at 7,6 but the leave taken is being calculated on 7.4849 and I can’t see where this can be changed.

- The system will calculate leave on a pro-rata basis.

- Hey Richard – one off unscheduled pay runs won’t affect sick leave entitlements, as long as the pay run that covers the sick leave anniversary is processed as a scheduled pay run.

- I don’t want to have to manually adjust the accrual each week – it should just calculate it based on the ordinary hours worked.

Keep your practice a step ahead with Xero accounting software. Register now for free access to education, resources, and information to help you run your business. Explore features and tools built for small businesses, accountants and bookkeepers.

I have found there to be no issues if the information is set up correctly. When this is done properly the calculations for both accrual and leave taken are correct for all employees.

Pay them on the day and frequency stated in the agreement and use the method of payment you agreed on. Make sure you provide your employees with statements of their pay showing any deductions or contributions made. If you have full time staff that get paid monthly or bi-monthly then set your accrual to fixed hours.