Content

Traditionally invoices are sent through the regular mail, and that’s certainly an option many businesses use today. Others will create and send invoices electronically via email. A purchase order is sent by a customer to a vendor, requesting goods or services.

The invoice tells the buyer how much they owe the seller and sets up payment terms for the transaction. An invoice is a record of the goods or services you provide to your clients and customers, and a method by which they can pay you for those goods or services. If you’re a contractor who fixed a roof, a makeup artist who styled a photo shoot, or an entrepreneur who just started a consulting business, it’s likely you need to send an invoice. Square has a ready-to-go, professional-looking invoice template that includes all the essential invoicing information. Square Invoices lets you create, send, and manage invoices and payments right from your Square Dashboard.

To get cash from customers, you need to remind them that they owe you money with an invoice. An invoice is a bill sent to a customer after they have already received a product or service.

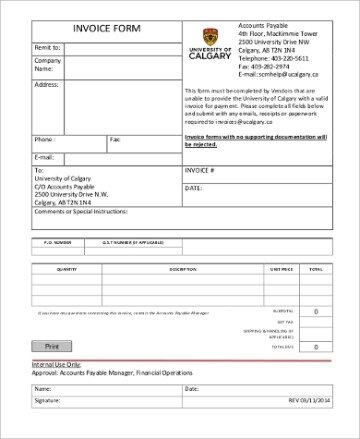

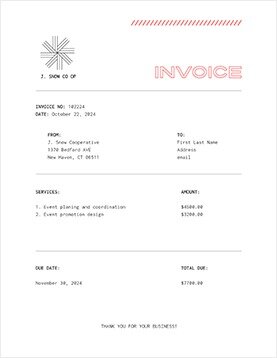

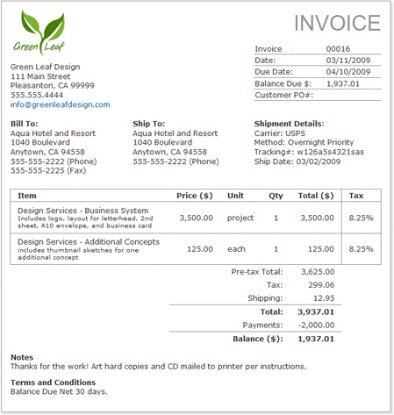

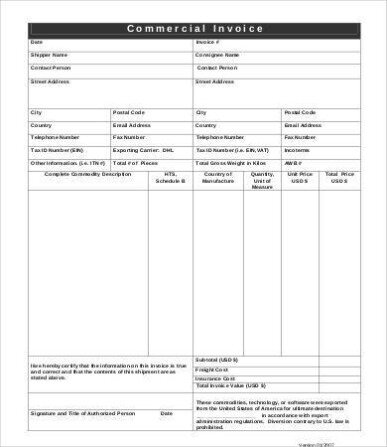

Invoice Templates

The payee uses data in the packing slip to apply for the payments. Self-billing invoice – A self billing invoice is used when a buyer issues the invoice to themselves (e.g. according to the consumption levels he is taking out of a vendor-managed inventory stock).

Therefore, the invoice date has essential information regarding payment, as it dictates the credit duration and due date of the bill. This is especially crucial for entities offering credit, such as net 30. The actual due date of the invoice is usually 30 days after the invoice date. Likewise, companies offer customers the option to return items typically have a deadline based on a certain number of days since proof of purchase, as indicated on the invoice. Payment terms may be outlined on the invoice, as well as the information relating to any discounts, early payment details or finance charges assessed for late payments.

Several e-invoicing standards, such as EDIFACT and UBL, have been developed around to world to facilitate adoption and efficiency. Invoicing is crucial for small businesses, because invoices are the business documents that enable companies to get paid for their services. For example, point of sale purchases, such as buying gas for a car at a gas station, have complete seller’s contact information but limited buyer’s information.

Invoices

It is the main document that serves as a bill for the service or products your business has provided. A properly created invoice is a legal document that provides a binding agreement. If you’re a small business, and you don’t send many invoices, you may not be ready for specialized software or a service like FreshBooks. In that case, you can quickly create invoices online using free templates and generators. Here are a few of the simplest and most effective, organized by format. After delivering a product or service, a company will create an invoice containing all details of the transaction and payment expectations. To begin, it’s important to note the date the invoice was created because it ensures both parties know when the payment is due.

People are least likely to pay an invoice received on Sunday—it’s the laziest day of the week, after all. With Square Invoices, you can add a message for the recipient to request that the customer issue payment upon receipt. We’ve found that invoices sent on Thursdays have the highest likelihood of being paid within two days. Online invoicing helps keep things from getting “lost in the mail.” Since online invoices are sent digitally, it’s always easy for clients to find them—all they need to do is search their inbox . Square Invoices features a professional-looking template in which you can fill in all the pertinent information related to the project or job.

But the most tech-savvy firms now employ specialist software to generate digital invoices immediately, with information flowing automatically between seller and buyer. But Square Invoices makes it super-easy to follow up with your delinquents. Because everything is sorted in your Dashboard by what’s been paid and what hasn’t, you can quickly go in and hit the Resend button for anyone who might need a reminder. That saves you the time of having to sit down and craft a bunch of awkward emails. For more tips on how to get those late invoices paid, read our post Three Ways to Get Clients to Pay Outstanding Invoices. To date, millions of dollars have been paid through Square Invoices. Based on some trends and data we’ve seen, here are some things you can do to ensure you receive your invoice payments quickly.

No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published.

By Accessing And Using This Page You Agree To The Terms And Conditions Terms And Conditions.

You can email your Invoice, download a PDF copy, or send your Invoice as a link, all using our Invoice generator. If you email your Invoice directly from Invoice Simple, we’ll notify you when your customer views the Invoice — useful for following up with them later. If you send a link to your customer, they can download or print the Invoice from the link. At Invoice Simple our goal is to make it as easy as possible to make invoices.

The “INVOIC” standard can also be used to transmit credit and debit memos. Collective Invoicing is also known as monthly invoicing in Japan. Japanese businesses tend to have many orders with small amounts because of the outsourcing system , or of demands for less inventory control . To save the administration work, invoicing is normally processed on monthly basis. Debit memo – When a company fails to pay or short-pays an invoice, it is common practice to issue a debit memo for the balance and any late fees owed. Our easy-to-use invoice templates make it simple to create professional-looking invoices in just a few clicks. Add your company logo and your own photos to customise your invoice and promote your unique brand.

A pro-forma invoice is a binding agreement, although the terms of sale are subject to change. While invoice don’t necessarily need to be numbered sequentially, you’ll need to establish a consistent invoice ID system and ensure you don’t assign an invoice number more than once. Yes Invoice is an online invoice software for freelancers and entrepreneurs. Free payroll setup to get you up and running and support to smoothly run payroll.

Net 30, or 30 days, is a common amount of time given to pay invoices, but choose payment terms that make sense for your business, your customer, and the transaction. Options range from requiring payment in advance, to net 90 terms which give customers 90 days to pay outstanding invoices. The cost and complexity of a project may factor into the payment terms you choose. To streamline your invoicing efforts, make the payment process easy. Provide customers with an easy way to pay your invoice to encourage on-time payments and improve their experience with your company. Using QuickBooks, you can create electronic invoices and accept payments from one location, improving the overall transaction for your team and your clients. A past due invoice is an unpaid invoice that is past its due date.

- They are very descriptive and include information about both parties involved in the transaction, while bills generally don’t contain any customer information and are more generic.

- Invoices help you make sure your accounting books are accurate.

- A description of items purchased, either products or services,including prices and quantities, will be included on the invoice.

- If you use accrual accounting, record the amount of the invoice as accounts receivable in your books.

- Learn more about what’s included in an invoice, how they work, and how to invoice a customer.

An invoice is a transactional tool businesses can use to record payments. Learn in-depth definitions and review helpful examples with this guide from QuickBooks.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy. Sequential invoice numbers make it easy to stay consistent and ensure you’re never assigning duplicate invoice IDs.

How Do Invoices Differ From Receipts And Purchase Orders?

Additionally, invoices can help you protect your company in the event of an audit, as they help to create a paper trail. Detailed invoices will show the IRS exactly where your money came from should they question your tax returns. Businesses can use invoices to track what customers owe in total as a way to monitor cash flow. GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services. GoCardless is used by over 55,000 businesses around the world. Learn more about how you can improve payment processing at your business today. Some industries may see businesses traditionally transacting on 60, 90, or even 120 day payment terms.