Content

- Employment Opportunities After Completing Xero Certification Course By Brainmeasures

- Sharie@fasteasyaccounting Com

- Beneficiaries Of Xero Certification Course By Brainmeasures

- What Do People Wish They Knew Before Earning Their Xero Certified?

- Serving Construction Contractorsacross The U S.aincluding Alaskaand Hawaii

Intuit, the maker of QuickBooks, offers a program through which the company will certify that you are competent with their software. Xero is the name of a software firm which advances cloud-based accounting software for small and medium-sized companies. This firmis based in New Zealand and has organizationsAustralia, the United Kingdom and the United States. Its products are centered on the software as a service SaaS model and sold by payment, based on the form and amount of company units managed by the subscriber.

In addition, you have access to an instructor who can answer all of your questions. If you want to see whether or not you can pass the exam based on your work experience and knowledge, take the free practice test. If not, at least you will have an idea of the specific areas that you need to focus on for your studies. However, you must schedule a day and time to take the exam by going to ATU. Once you have done so, you will receive the exam via email 24 hours before your scheduled exam time.

Employment Opportunities After Completing Xero Certification Course By Brainmeasures

For parts 3 and 4, you can fax or mail your exam to AIPB for grading. If you do not pass any part of the exam, you can take retake parts 1 and 2 for $60 each and you can retake parts 3 and 4 for $25 each. every 30 minutes, you need to connect to Xero by registering a Private App.

The exam consists of 50 multiple choice questions and simulations. To pass the exam, you must score at least 75%, or 37 out 50 questions correct. However, the exam is open book and you are given two hours to complete the exam. Earning your way towards a Xero Advisor certification is a studious but worthwhile effort. With the Xero certification, you can assure your clients that you have the sufficient knowledge and expertise to handle their accounts and help them in their finance and accounting needs using the Xero accounting software.

It is far cheaper and more effective than having your CPA fix your QuickBooks and correct it during tax season. It only makes sense to subcontract it out to professional construction accountants who have done it thousands of time and have a process in place to see to it that it gets done right.

We scan your receipts and invoices link them to QuickBooks transactions where it is appropriate and give you back a CPA-ready packet for your tax return. And we provide ongoing Cloud Based Contractors Bookkeeping Servicesby accountants who understand construction. We have aConstruction Bookkeeping Services System – With workflow processes for everything including paper sorting. Which means once it arrives no matter how organized or disorganized it is we need to pre-process everything before it enters our workflow where it is scanned and uploaded into paperless servers in the cloud? Hopefully you not having to sort anything will save you time and money. We have used several of the largest and highest rated Intuit Approved Commercial Hosting Services and have found they all have good and bad points.

Also accounting theory teaches you why things are done either a certain way or in a certain order. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. The QuickBooks exam is overseen by the National Association of Certified Public Bookkeepers . You can take the exam online through the Accountant Training and Testing Center .When you are ready to take the exam, go to the ATTC’s Schedule a Test web page and schedule a date and time you want to take the test. The ATTC will then email you information about your schedule date and time for the exam.

Sharie@fasteasyaccounting Com

Xero offers a variety of resources to help you gain deeper knowledge about the software, its features, and how you can leverage the software to automate your accounting and bookkeeping. These blogs, podcasts, and videos will go a long way, and will help you beyond your goal of receiving a Xero adviser certification. QuickBooks Proadvisor, you get access to QuickBooks certification for free. If you go through these two free programs and pass your certification test, you’re eligible for listing in the QuickBooks Find-a-Proadvisor directory. Xero have certification programs, giving certified accountants bonus perks and exposure. Today, we’ll take a look at how those programs work and what the benefits of joining up are. Become proficient with the core features of Xero and get the knowledge and skills you need to serve clients well by completing the Xero advisor certification program.

Intuit recommends that you have at least two years of experience using QuickBooks for tasks related to payroll and invoicing, as well as budgeting and cost reports. In order to read or download xero certification test answers ebook, you need to create a FREE account. After the tests are developed, they are sent for a technical review within our organization. At this stage, our team of experienced and qualified faculty members examine the suitability and correctness of the test and help identify for any discrepancies. Technical reviews are extremely beneficial since they provide a significant number of views and recommendations for improved testing.

- The conference is the premier event of the year for the accounting and financial professionals and the add-on developer community.

- If you want to see whether or not you can pass the exam based on your work experience and knowledge, take the free practice test.

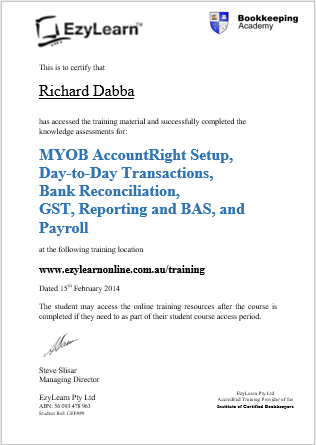

- Copies of certificates from other organizations must be submitted.

- If you do not pass any part of the exam, you can take retake parts 1 and 2 for $60 each and you can retake parts 3 and 4 for $25 each.

If you have more work experience than you do education as a bookkeeper or accountant, then you should apply for your license through the work experience path. This means that you must have at least two years of experience working as a bookkeeper or accountant. The NACPB offers both a bookkeeper certification and a bookkeeper license program. During our research, we found that the bookkeeper license program is more comparable to the bookkeeper certification program offered by the AIPB. For this reason, we decided to provide you with the requirements for the bookkeeper license program that is offered by the NACPB. Ed2go has a hybrid program that includes self-paced work with access to an instructor. This program includes the six workbooks that we discussed in the previous section as well as the cost of sitting for parts 1 and 2 of the exam.

A final exam is also included at the end of each workbook, which you should treat as a “practice” exam. Upon completion of parts 1 and 2 at the Prometric Test Center, you will immediately receive your test scores.

When this happens we recommend you invest in a tool to access their books, whether it be hosting, or other remote option. Becoming an official certified QuickBooks ProAdvisor will help you propel your business forward and grow. We are often asked if we think it’s worth the time and investment to become a certified Bookkeeper and you will come across thousands of programs and courses that provide a course and may provide you a certificate. Your potential prospects may not even know what the certificate even means. What really matters is that you understand bookkeeping, and that you feel you can do the work. Accountex USA provides a four-day learning experience that focuses around the technology that moves accounting forward as well as the business processes and organizational success needed in the marketplace. As an independent conference, the content offers more than a single perspective on solutions.

The official exam is open book, so feel free to use your study guide during your practice exams. There are online tutorials available on the official QuickBooks website that you can access for free. These tutorials can walk you through certain processes or sections in QuickBooks.

Beneficiaries Of Xero Certification Course By Brainmeasures

They understand the challenges you face and can offer guidance on everything from complex accounting questions and payroll interpretation to mastering advanced features of QuickBooks. ProAdvisors have taken a 3-part QuickBooks Certification course and have successfully completed comprehensive testing. They may read a book, take a class or two, or they may use an accounting program and therefore say they are a bookkeeper. Just being able to use the software and using it properly are two different things. There are several free practice exams available online through Intuit and other training programs. QuickBooks is one of the many types of bookkeeping software commonly used by individuals and small businesses.

Self-taught means making a lot of the same mistakes over and over and it takes a long time. Learning from a master is much faster and in the end allows the student the opportunity to go beyond the teachings of the master and have an even greater success. Since all learning is based upon connecting new things to things we already understand most contractors fall into a trap of only knowing what they know and not knowing what they don’t know.

You must complete an application, meet the work experience requirements, pass the 4-part certification exam, agree to and sign the code of ethics, and maintain the required continuing education units. While not all positions require a degree, aspiring bookkeepers benefit from an online associate or bachelor’s degree in bookkeeping, accounting, or a related field. Bookkeepers can also obtain certified public bookkeeper credentials. Prospective bookkeepers can train for their profession in several ways, such as through an associate degree in bookkeeping or accounting, which usually takes two years to complete. During an associate program, students gain math and accounting skills. An associate degree in bookkeeping also prepares graduates to transfer into a bachelor’s program. Bookkeeper responsibilities include recording financial transactions, overseeing an organization’s general ledger, and creating financial reports.

AICPA represents certified public accountants and offers resources for accounting professionals considering additional training in the field. The institute provides career planning information, professional development tools, and scholarships for accounting students. A professional organization for bookkeepers, AIPB offers a newsletter and an answerline to keep bookkepers up to date in the field.

The learning center also helps Xero users to prepare for the certification through structured learning programs. Becoming a Xero certified advisor is a testament to one’s skill and knowledge in using Xero, its many features and the add-ons that are compatible with your business. However, getting a certification from Xero is not as easy as it sounds. I’m just starting to look into setting up a Xero account to potentially get certified.

In addition, they offer an exam prep course for $1,596 for NACPB members and $1,996 for nonmembers. UCSD Extension offers a prep course that is taught by a live instructor. It uses the six workbooks that we have discussed and it may meet once or twice per week, depending on the course offering. It is taught in San Diego at the UCSD campus and, similar to Ed2go, the cost is $1,995 and includes all six workbooks and the test fees for parts 1 and 2 of the exam.

In either version, you’ll spend the first day on basics and the second day going over more advanced topics. First, you attend some classes offered by Intuit, then you work through the practice materials, and finally you take an exam.

A score of at least 80% is required to pass and receive “Certified Advisor” status. Accountex USA is offering a full day Xero Certification course at the pre-con workshops on November 15, 2016. Xero is one of the fastest adopted accounting software solutions, used by over 700,000 businesses in 180 countries. Yes it does and it is one of the few programs that links to QuickBooks without causing major problems. A lot of programs claim to link to QuickBooks and then act like a predatory software by changing the underlying transactions in a way that can cause a lot of damage and cost many thousands of dollars to repair. We are very careful about recommending any software that links to QuickBooks and only after we have thoroughly tested it. Construction Accounting Is Used In MobileEnvironments – Which means having a contractors bookkeeping services system that can track the costs that contractors incur related to doing custom work in a strictly mobilization environment.

QuickBooks Premier Contractors Edition provides a running scorecard ofKey Performance Reportsand when used with Business Process Management Tools likewhat 10 minutes of waste costs their company. This same thing applies for why it is a bad idea to give your outsourced construction accounting services access to your C.P.A.’s tax preparation software. In fact I am not aware of anyone who would give access to their tax preparation software. Right now if you are like most construction contractors your construction accounting records are in an unlocked file cabinet or worse, sitting on someone’s desk. We take security very serious and are constantly looking at our systems. We utilize 128-bit SSL encryption which enables clients to verify authenticity and to securely communicate with our servers.

Serving Construction Contractorsacross The U S.aincluding Alaskaand Hawaii

Bill.com is committed to protecting the security and privacy of your information. We know that information regarding you and your company is extremely important and confidential. Bill.com uses the industry’s most advanced security and process controls to ensure that the security, confidentiality, and availability of your data is protected. Bill.com is a US-based corporation and all storage and processing of data is done in the US. Thanks to all authors for creating a page that has been read 243,194 times. Look for a center nearest to you through the Accountant Training and Testing Center .

To achieve certification, you must successfully pass a 55-question exam. The exam is broken up into seven sections, and you must achieve a score of 80% or higher to advance to the next section. Its primary goal is to help ensure that only qualified bookkeepers provide bookkeeping services.

I have no formal work experience in bookkeeping and as a SAHM, there’s no way I can go work a regular job to get the experience faster. I was hoping there would be some kind of training program that would give me the training I need for freelancing. Below we’ve included a few details on the certification programs available for four of the top accounting software programs used by millions of small businesses all over the world. The fourth step in the AIPB certification process is to agree to adhere to the code of ethics.