Content

Payroll needs to have the ability for the employer to add notes to the individuals payslip. I had this feature in another package & it is very handy feature. Add 1099 contractors as contacts, then set up rules so expenses are automatically recorded on 1099 forms. File 1099 forms with the IRS using Track1099, Tax1099 or a service like PayPal.

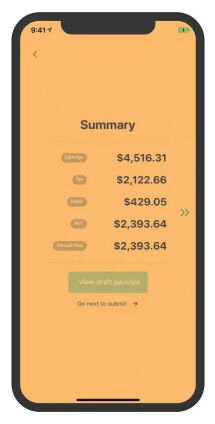

Following last week’s release, you can now add a Memo from within a draft pay run. You’ll find the Memo button on the right hand side of the draft pay run screen next to the employees’ Net Pay amounts. However, its for a person not residing in Australia from Australian Payroll. His tax is paid overseas but we want him to be in our payroll as we want to calculate his leave etc. We have just started employing people in out business and this is the first time we need to pay stat holiday pay.

More About Payroll

They do not accrue entitlements though, so usually this makes the pay rate they get per hour higher depending on what you arrange with them of course. Can anyone please recommend a payroll add-on that is not too expensive? Garnishments are legal documents that require businesses to collect a debt that’s owed by an employee. Employers are required to take this money out after tax and send it directly to the garnishor. If you offer health insurance that isn’t part of a pre-tax benefit plan, the payments your employee has authorized you to make on their behalf come out after tax. These amounts are taken out only after the employee has paid tax on their income. If you have a full or part-time employee, you will have to make deductions like these.

Xero creates a payment file each pay run, so it’s easy to make payments from Xero into employee bank accounts. Use pay runs to process and record your employee pay runs.

In my case I need to advise employees of personal leave used without certificate. I am migrating a client to Xero and Like Felicity I also like to add a permanent note to payslips. Best advice from what I have seen in the past is to employ them as a contractor. They will need to invoice you for their hours and deal with the Chinese business regulations themselves.

Doing the pay runs for any public holiday weeks is a nightmare. Hi everyone, Come on over to the new discussions in Xero Central. It’s a more intuitive way to connect and chat all things business with one another. To deduct health, dental or vision insurance before tax, ensure your insurance plan is considered a pre-tax benefit. Health Savings Account, Flexible Spending Accounts and Dependent care contributions are all made before tax as well. “Xero” and “Beautiful business” are trademarks of Xero Limited. Access all Xero features for 30 days, then decide which plan best suits your business.

I have now managed to upload my logo in Settings/Payroll but is not showing on my payslips. it is ridiculous it has taken so long, At least the company name and address are on the slips.

Xero Became A Really Critical Tool For Us As We Took On More Staff

“Small business owners are always searching for ways to cut down manual processes and this solution does just that. It allows them to get on with the business of running their business while leaving the numbers to me.” We’ll tell you when and what you have to file and pay. For the moment, you’ll need to complete this outside of Xero for now.

You’ll receive email reminders to ensure you don’t miss any filing deadlines. books up to date, with journals created automatically.

Corporate employees who get vaccinated will get four hours added to their paid time off bank. The platform is also set up to remind small business owners when they have to file and pay payroll taxes so they don’t miss deadlines. Xero will soon support electronic filing and payments for your payroll tax.

Flexible Payroll Filing

Keep an in mind the total cost you want to incur for the business. Hey so right now you can’t include the Attachment of Earnings in the Opening Balances – so Xero doesn’t automatically calculate the amount to be deducted. I used to write the dates on call payments were in relation to which was very handy.

Entering all the employee info and salary/wages details, tax codes and filing codes for the Inland Revenue. Is it possible to add a note permanently to each staff members payslips. I have clients with a mixture of casual and perm staff and the casuals will always be casual. I would like to add the note that their rate is inclusive of casual loading without having to remember to repeat that each time I do a pay run. Obviously this doesnt need to be included on the perm staff payslips though.

Xero aims to ship payroll for all 50 states in the next 12 months. The incentive is available to crew at corporate-owned McDonald’s in the U.S. About 5% of McDonald’s 14,000 U.S. restaurants are corporate-owned.

Payroll in Xero calculates relevant business days and displays both the File By and Due By dates to keep you informed of key deadlines. You’ll need to manually file and pay your payroll taxes directly with your state tax board in the short term. But don’t worry, we’re working on supporting electronic filing and payments for Pennsylvania. Tax filings and payments can be completed directly through the Pennsylvania Department of Revenue. Ensure that the usual pay run for the period has been posted with any leave taken in that period processed. This article will take you through the steps of processing a commission or bonus payment through Xero’s payroll. Also find that the fourth line of our address is not showing fully on the payslip.

Xero Me is for employees and payroll admins of businesses who use Xero to manage payroll. Xero Me allows employees to check their pay history, submit timesheets and manage leave requests from anywhere. Cloud accounting software company Xero has added payroll for employers and employees in the state of Pennsylvania. Xero has all the tools you need to process payroll, manage leave, timesheets and pay superannuation. First, ensure your payroll settings are configured correctly for your business. If you’re working out the deductions manually, then set a decent amount of time aside for the job. If you have several employees, it might make more sense to use software which can do the calculations for you.

If you have employees in Pennsylvania, you can now pay them through Xero. Pay your employees through direct deposit or with instant paychecks. Over 190,000 small businesses in Pennsylvania employ at least one employee.

- Is it possible to add a note permanently to each staff members payslips.

- Xero will soon support electronic filing and payments for your payroll tax.

- Xero payroll comes with all the standard types of leave set up – plus you can set up rostered days off and time in lieu.

- Doing the pay runs for any public holiday weeks is a nightmare.

- If employees have the option to contribute to a Roth IRA, Roth 401, or Roth 403 with your company, then take out those payments after tax.

At the moment we have to maintain a separate spreadsheet for each Earnings Order and refer to it before processing the payslips each week – far from ideal. View a wide range of payroll reports to get valuable information on payroll activity, transactions, remuneration and pension contributions.

Payroll And Accounting In One

We’d like to bring our payroll in house so we have more control over it. Also, there are only a couple of employees but one of them is the company owner/director. Like with all new software, you just have to get used to it and understand how it works. Running xero payroll from the new tax year helps you out enormously as you have no ytd balances to enter. Our wages are currently outsourced to a bookkeeper and my employer wants to bring them in house from the new tax year. I currently gather together all of the hours and work out the overtime for the bookkeeper, they run them in Sage payroll, send me the figures and I pay them. From this i have some idea of tax codes and how much each employee earns, hourly rate etc.